6. Regresión lineal#

Abordemos las primeras ideas de regresión lineal a través de un ejemplo práctico:

Creamos dos variables, Ingreso y Consumo Esperado

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import random

import statsmodels.formula.api as stm

from statsmodels.graphics.regressionplots import abline_plot

df = pd.DataFrame({

'Col1': [1,2,3],

'Col2': [4,5,6]

})

familia = pd.DataFrame({'Y':[55,60,65,70,75,

65,70,74,80,85,88,

79,84,90,94,98,

80,93,95,103,108,113,115,

102,107,110,116,118,125,

110,115,120,130,135,140,

120,136,140,144,145,

135,137,140,152,157,160,162,

137,145,155,165,175,189,

150,152,175,178,180,185,191

],'X':[80,80,80,80,80,

100,100,100,100,100,100,

120,120,120,120,120,

140,140,140,140,140,140,140,

160,160,160,160,160,160,

180,180,180,180,180,180,

200,200,200,200,200,

220,220,220,220,220,220,220,

240,240,240,240,240,240,

260,260,260,260,260,260,260

]})

familia.head()

| Y | X | |

|---|---|---|

| 0 | 55 | 80 |

| 1 | 60 | 80 |

| 2 | 65 | 80 |

| 3 | 70 | 80 |

| 4 | 75 | 80 |

ingresos = np.arange(80,261,20)

ingresos

consumoEsperado = [65,77,89,101,113,125,137,149,161,173]

consumoEsperado

familia.columns

Index(['Y', 'X'], dtype='object')

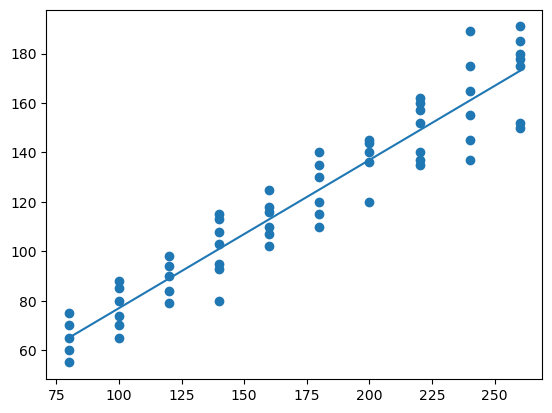

plt.figure() # llama al dispositivo grafico

plt.plot(ingresos,consumoEsperado)

plt.scatter(familia['X'],familia['Y'])

plt.show()

¿Qué hemos hecho?

¿Qué significa que sea lineal?

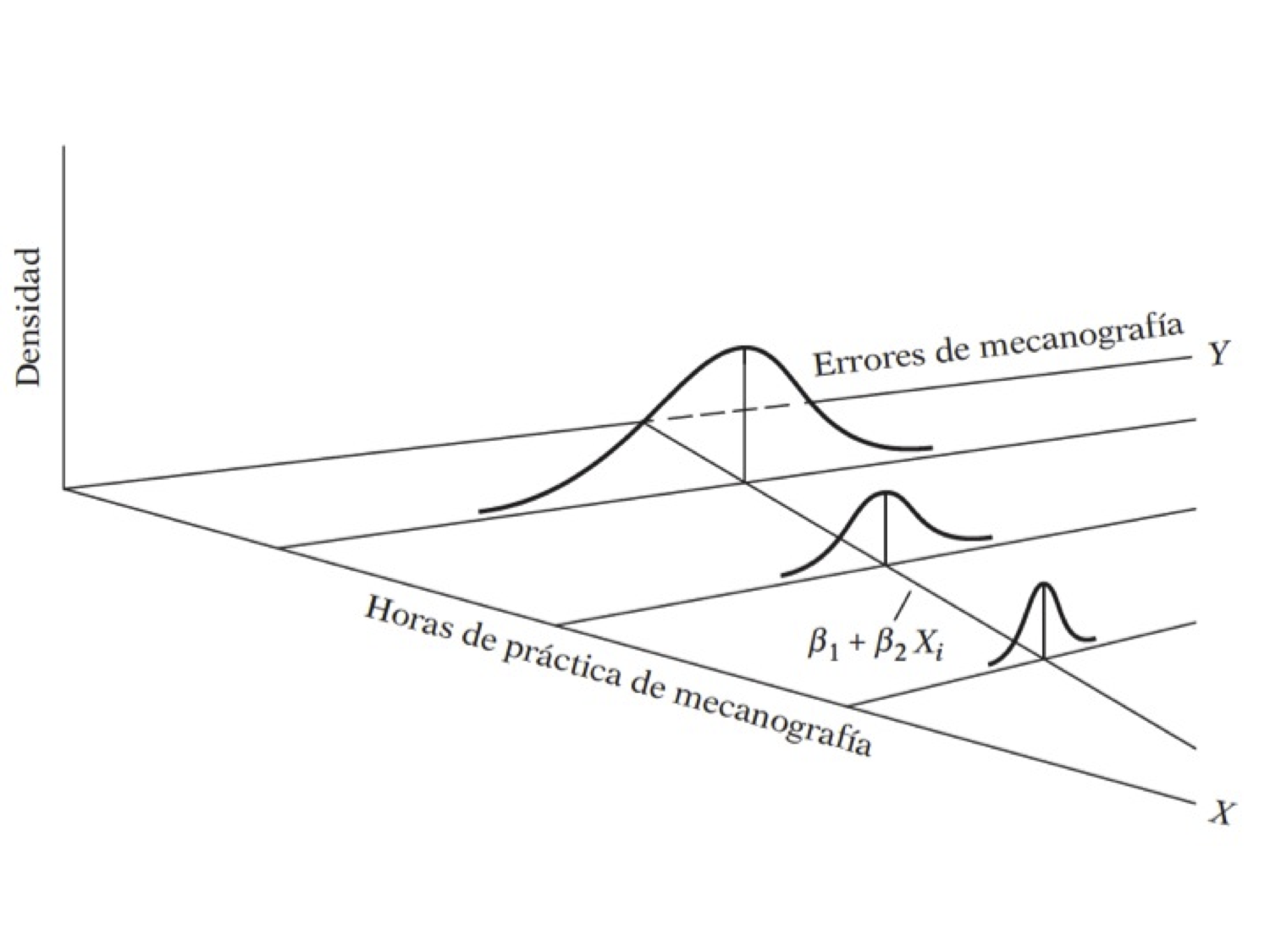

El término regresión lineal siempre significará una regresión lineal en los parámetros; los \(\beta\) (es decir, los parámetros) se elevan sólo a la primera potencia. Puede o no ser lineal en las variables explicativas \(X\).

Para evidenciar la factibilidad del uso de RL en este caso, vamos a obtener una muestra de la población:

nS = familia.shape

type(nS)

indice = np.arange(0,nS[0])

indice # Creamos una variable indicadora para obtener una muestra

array([ 0, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16,

17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33,

34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50,

51, 52, 53, 54, 55, 56, 57, 58, 59])

random.seed(8519)

muestra = random.sample(list(indice),k = 20) # cambio de array a lista

muestra # samos sample para obtener una muestra sin reemplazo del tamaño indicado

[54, 59, 33, 25, 32, 39, 47, 51, 18, 3, 34, 12, 29, 7, 26, 5, 56, 50, 44, 13]

ingreso_muestra = familia.loc[muestra,'X']

consumo_muestra = familia.loc[muestra,'Y']

df = pd.DataFrame(list(zip(consumo_muestra,ingreso_muestra)),columns = ['consumo_muestra','ingreso_muestra'])

ajuste_1 = stm.ols('consumo_muestra~ingreso_muestra',data =df).fit()

print(ajuste_1.summary())

OLS Regression Results

==============================================================================

Dep. Variable: consumo_muestra R-squared: 0.909

Model: OLS Adj. R-squared: 0.904

Method: Least Squares F-statistic: 179.4

Date: Wed, 16 Apr 2025 Prob (F-statistic): 8.44e-11

Time: 04:04:54 Log-Likelihood: -76.677

No. Observations: 20 AIC: 157.4

Df Residuals: 18 BIC: 159.3

Df Model: 1

Covariance Type: nonrobust

===================================================================================

coef std err t P>|t| [0.025 0.975]

-----------------------------------------------------------------------------------

Intercept 13.2650 8.817 1.504 0.150 -5.259 31.789

ingreso_muestra 0.6226 0.046 13.394 0.000 0.525 0.720

==============================================================================

Omnibus: 3.437 Durbin-Watson: 2.369

Prob(Omnibus): 0.179 Jarque-Bera (JB): 2.288

Skew: -0.828 Prob(JB): 0.319

Kurtosis: 2.997 Cond. No. 634.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

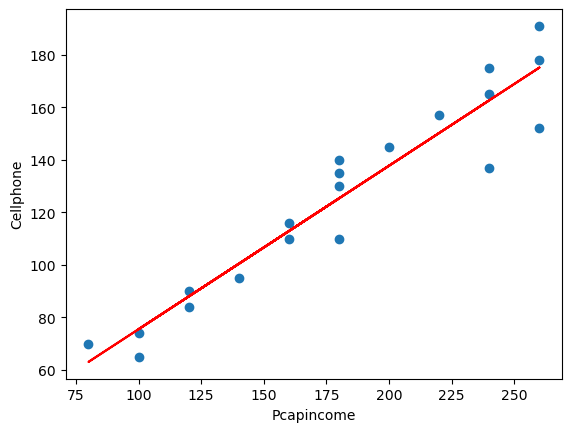

plt.figure()

plt.plot(df.ingreso_muestra,df.consumo_muestra,'o')

plt.plot(df.ingreso_muestra,ajuste_1.fittedvalues,'-',color='r')

plt.xlabel('Pcapincome')

plt.ylabel('Cellphone')

Text(0, 0.5, 'Cellphone')

6.1. Regresión: Paso a paso#

La función poblacional sería:

Como no es observable, se usa la muestral

Es por esto que los residuos se obtienen a través de los betas:

Diferenciando se obtiene:

donde

Abrimos la tabla3.2, vamos a obtener:

salario promedio por hora (Y) y

los años de escolaridad (X).

consumo = pd.read_csv('https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Tabla3_2.csv',

sep = ';',decimal = '.')

consumo.head()

| Y | X | |

|---|---|---|

| 0 | 70 | 80 |

| 1 | 65 | 100 |

| 2 | 90 | 120 |

| 3 | 95 | 140 |

| 4 | 110 | 160 |

media_x = np.mean(consumo['X'])

media_y = np.mean(consumo['Y'])

n = consumo.shape[0]

sumcuad_x = np.sum(consumo['X']*consumo['X'])

sum_xy = np.sum(consumo['X']*consumo['Y'])

beta_som = (sum_xy-n*media_x*media_y)/(sumcuad_x-n*(media_x**2))

alpha_som = media_y-beta_som*media_x

(alpha_som,beta_som)

(24.454545454545467, 0.509090909090909)

Verificamos lo anterior mediante:

reg_1 = stm.ols('Y~X',data = consumo)

print(reg_1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: Y R-squared: 0.962

Model: OLS Adj. R-squared: 0.957

Method: Least Squares F-statistic: 202.9

Date: Wed, 16 Apr 2025 Prob (F-statistic): 5.75e-07

Time: 04:04:55 Log-Likelihood: -31.781

No. Observations: 10 AIC: 67.56

Df Residuals: 8 BIC: 68.17

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 24.4545 6.414 3.813 0.005 9.664 39.245

X 0.5091 0.036 14.243 0.000 0.427 0.592

==============================================================================

Omnibus: 1.060 Durbin-Watson: 2.680

Prob(Omnibus): 0.589 Jarque-Bera (JB): 0.777

Skew: -0.398 Prob(JB): 0.678

Kurtosis: 1.891 Cond. No. 561.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

/Users/victormorales/opt/anaconda3/lib/python3.9/site-packages/scipy/stats/_stats_py.py:1806: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=10

warnings.warn("kurtosistest only valid for n>=20 ... continuing "

Veamos cómo queda nuestra estimación:

y_ajustado = alpha_som+beta_som*consumo['X']

dfAux = pd.DataFrame(list(zip(consumo['X'],y_ajustado)),

columns = ['X','y_ajustado'])

dfAux

| X | y_ajustado | |

|---|---|---|

| 0 | 80 | 65.181818 |

| 1 | 100 | 75.363636 |

| 2 | 120 | 85.545455 |

| 3 | 140 | 95.727273 |

| 4 | 160 | 105.909091 |

| 5 | 180 | 116.090909 |

| 6 | 200 | 126.272727 |

| 7 | 220 | 136.454545 |

| 8 | 240 | 146.636364 |

| 9 | 260 | 156.818182 |

e = consumo['Y']-y_ajustado

dfAux = pd.DataFrame(list(zip(consumo['X'],consumo['Y'],y_ajustado,e)),

columns = ['X','Y','y_ajustado','e'])

dfAux

| X | Y | y_ajustado | e | |

|---|---|---|---|---|

| 0 | 80 | 70 | 65.181818 | 4.818182 |

| 1 | 100 | 65 | 75.363636 | -10.363636 |

| 2 | 120 | 90 | 85.545455 | 4.454545 |

| 3 | 140 | 95 | 95.727273 | -0.727273 |

| 4 | 160 | 110 | 105.909091 | 4.090909 |

| 5 | 180 | 115 | 116.090909 | -1.090909 |

| 6 | 200 | 120 | 126.272727 | -6.272727 |

| 7 | 220 | 140 | 136.454545 | 3.545455 |

| 8 | 240 | 155 | 146.636364 | 8.363636 |

| 9 | 260 | 150 | 156.818182 | -6.818182 |

np.mean(e)

np.corrcoef(e,consumo['X'])

array([[1.00000000e+00, 1.13838806e-15],

[1.13838806e-15, 1.00000000e+00]])

SCT = np.sum((consumo['Y']-media_y)**2)

SCE = np.sum((y_ajustado-media_y)**2)

SCR = np.sum(e**2)

R_2 = SCE/SCT

R_2

0.9620615604867568

print(reg_1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: Y R-squared: 0.962

Model: OLS Adj. R-squared: 0.957

Method: Least Squares F-statistic: 202.9

Date: Wed, 16 Apr 2025 Prob (F-statistic): 5.75e-07

Time: 04:04:55 Log-Likelihood: -31.781

No. Observations: 10 AIC: 67.56

Df Residuals: 8 BIC: 68.17

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 24.4545 6.414 3.813 0.005 9.664 39.245

X 0.5091 0.036 14.243 0.000 0.427 0.592

==============================================================================

Omnibus: 1.060 Durbin-Watson: 2.680

Prob(Omnibus): 0.589 Jarque-Bera (JB): 0.777

Skew: -0.398 Prob(JB): 0.678

Kurtosis: 1.891 Cond. No. 561.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

/Users/victormorales/opt/anaconda3/lib/python3.9/site-packages/scipy/stats/_stats_py.py:1806: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=10

warnings.warn("kurtosistest only valid for n>=20 ... continuing "

[Ejemplo 2.3] Salario del CEO y retorno sobre el capital

\(y\): Salario anual en miles de dólares

\(x\): Retorno sobre el capital (ROE) promedio de la firma en los últimos 3 años.

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/ceosal1.csv"

datos = pd.read_csv(uu)

datos.columns = ["salary","pcsalary" ,"sales", "roe","pcroe","ros","indus","finance",

"consprod" ,"utility" , "lsalary" , "lsales" ]

reg_ceosal1 = stm.ols('salary~roe',data = datos)

print(reg_ceosal1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: salary R-squared: 0.013

Model: OLS Adj. R-squared: 0.008

Method: Least Squares F-statistic: 2.767

Date: Wed, 16 Apr 2025 Prob (F-statistic): 0.0978

Time: 04:04:56 Log-Likelihood: -1804.5

No. Observations: 209 AIC: 3613.

Df Residuals: 207 BIC: 3620.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 963.1913 213.240 4.517 0.000 542.790 1383.592

roe 18.5012 11.123 1.663 0.098 -3.428 40.431

==============================================================================

Omnibus: 311.096 Durbin-Watson: 2.105

Prob(Omnibus): 0.000 Jarque-Bera (JB): 31120.902

Skew: 6.915 Prob(JB): 0.00

Kurtosis: 61.158 Cond. No. 43.3

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Si \(roe=0\), el salario predicho es igual al intercepto, USD \(963.191,00\).

Si el \(roe\) aumenta un punto porcentual, \(\Delta roe=1\), entonces el salario cambia USD \(18.500,00\)

Como la ecuación es lineal, este resultado no depende del salario inicial.

[Ejemplo 2.4] Salario y Educación

\(y\): Salario, medido en dólares por hora.

\(x\): años de educación.

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/wage1.csv"

datos = pd.read_csv(uu)

datos.columns = ["wage" , "educ" , "exper" , "tenure" , "nonwhite", "female" , "married" , "numdep",

"smsa" , "northcen" ,"south" , "west" , "construc" ,"ndurman" , "trcommpu" ,"trade",

"services" ,"profserv", "profocc" , "clerocc" , "servocc" ,"lwage" , "expersq" , "tenursq" ]

reg_sal = stm.ols("wage~educ",data = datos)

print(reg_sal.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: wage R-squared: 0.164

Model: OLS Adj. R-squared: 0.163

Method: Least Squares F-statistic: 102.9

Date: Wed, 16 Apr 2025 Prob (F-statistic): 3.44e-22

Time: 04:04:57 Log-Likelihood: -1383.4

No. Observations: 525 AIC: 2771.

Df Residuals: 523 BIC: 2779.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -0.8916 0.686 -1.300 0.194 -2.239 0.456

educ 0.5406 0.053 10.143 0.000 0.436 0.645

==============================================================================

Omnibus: 211.871 Durbin-Watson: 1.825

Prob(Omnibus): 0.000 Jarque-Bera (JB): 803.455

Skew: 1.859 Prob(JB): 3.40e-175

Kurtosis: 7.787 Cond. No. 60.2

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

En promedio, un año más de educación genera un aumento de 0.5406 dólares más en el salsario por ahora.

[Ejemplo 2.5] Resultados de la votación y gastos de campaña

\(y\): \(voteA\), es el porcentaje de voto recibido por el candidato A.

\(x\): \(shareA\) es el porcentaje del total de campaña gastado por el candidato A.

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/vote1.csv"

datos = pd.read_csv(uu)

datos.columns = ["state" ,"district", "democA", "voteA" , "expendA" , "expendB", "prtystrA" ,"lexpendA",

"lexpendB" ,"shareA" ]

reg_vote = stm.ols("voteA~shareA",data = datos)

print(reg_vote.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: voteA R-squared: 0.856

Model: OLS Adj. R-squared: 0.855

Method: Least Squares F-statistic: 1018.

Date: Wed, 16 Apr 2025 Prob (F-statistic): 6.63e-74

Time: 04:04:57 Log-Likelihood: -565.20

No. Observations: 173 AIC: 1134.

Df Residuals: 171 BIC: 1141.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 26.8122 0.887 30.221 0.000 25.061 28.564

shareA 0.4638 0.015 31.901 0.000 0.435 0.493

==============================================================================

Omnibus: 20.747 Durbin-Watson: 1.826

Prob(Omnibus): 0.000 Jarque-Bera (JB): 44.613

Skew: 0.525 Prob(JB): 2.05e-10

Kurtosis: 5.255 Cond. No. 112.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

Esto significa que si la proporción del gasto del candidato A aumenta en un punto porcentual, el candidato \(A\) recibe casi medio punto porcentual (\(0,464\)) más del voto total.

En algunos casos, el análisis de regresión no se utiliza para determinar la causalidad, sino simplemente para observar si dos variables están relacionadas positiva o negativamente, de forma muy similar a un análisis de correlación estándar.

6.1.1. Incorporando no linealidades en la regresión simple#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/wage1.csv"

datos = pd.read_csv(uu)

datos.columns = ["wage" , "educ" , "exper" , "tenure" , "nonwhite", "female" , "married" , "numdep",

"smsa" , "northcen" ,"south" , "west" , "construc" ,"ndurman" , "trcommpu" ,"trade",

"services" ,"profserv", "profocc" , "clerocc" , "servocc" ,"lwage" , "expersq" , "tenursq" ]

reg_wage = stm.ols("lwage~educ",data = datos)

print(reg_wage.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lwage R-squared: 0.185

Model: OLS Adj. R-squared: 0.184

Method: Least Squares F-statistic: 119.0

Date: Wed, 16 Apr 2025 Prob (F-statistic): 4.19e-25

Time: 04:04:57 Log-Likelihood: -358.91

No. Observations: 525 AIC: 721.8

Df Residuals: 523 BIC: 730.3

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 0.5862 0.097 6.017 0.000 0.395 0.778

educ 0.0826 0.008 10.909 0.000 0.068 0.097

==============================================================================

Omnibus: 11.629 Durbin-Watson: 1.803

Prob(Omnibus): 0.003 Jarque-Bera (JB): 13.615

Skew: 0.265 Prob(JB): 0.00111

Kurtosis: 3.585 Cond. No. 60.2

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

El salario aumenta un 8,3% por cada año adicional de educación: el retorno de un año extra de educación.

Calcular

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/ceosal1.csv"

datos = pd.read_csv(uu)

datos.columns = ["salary","pcsalary" ,"sales", "roe","pcroe","ros","indus","finance",

"consprod" ,"utility" , "lsalary" , "lsales" ]

reg_ceolog = stm.ols("lsalary~lsales",data = datos)

print(reg_ceolog.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lsalary R-squared: 0.211

Model: OLS Adj. R-squared: 0.207

Method: Least Squares F-statistic: 55.30

Date: Wed, 16 Apr 2025 Prob (F-statistic): 2.70e-12

Time: 04:04:58 Log-Likelihood: -152.50

No. Observations: 209 AIC: 309.0

Df Residuals: 207 BIC: 315.7

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 4.8220 0.288 16.723 0.000 4.254 5.390

lsales 0.2567 0.035 7.436 0.000 0.189 0.325

==============================================================================

Omnibus: 84.151 Durbin-Watson: 1.860

Prob(Omnibus): 0.000 Jarque-Bera (JB): 403.831

Skew: 1.507 Prob(JB): 2.04e-88

Kurtosis: 9.106 Cond. No. 70.0

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

El coeficiente de \(log(ventas)\) es la elasticidad estimada del salario con respecto a las ventas. Implica que un aumento del \(1\%\) en las ventas de la empresa aumenta el salario de los directores ejecutivos en aproximadamente un \(0,257\%\): la interpretación habitual de una elasticidad.

Otro ejemplo

uu = 'https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/table2_8.csv'

datos = pd.read_csv(uu,sep = ';')

datos.shape

datos.columns

m1 = stm.ols('FOODEXP~TOTALEXP',data = datos)

print(m1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: FOODEXP R-squared: 0.370

Model: OLS Adj. R-squared: 0.358

Method: Least Squares F-statistic: 31.10

Date: Wed, 16 Apr 2025 Prob (F-statistic): 8.45e-07

Time: 04:04:58 Log-Likelihood: -308.16

No. Observations: 55 AIC: 620.3

Df Residuals: 53 BIC: 624.3

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 94.2088 50.856 1.852 0.070 -7.796 196.214

TOTALEXP 0.4368 0.078 5.577 0.000 0.280 0.594

==============================================================================

Omnibus: 0.763 Durbin-Watson: 2.083

Prob(Omnibus): 0.683 Jarque-Bera (JB): 0.258

Skew: 0.120 Prob(JB): 0.879

Kurtosis: 3.234 Cond. No. 3.66e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 3.66e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

Regresamos el gasto total en el gasto en alimentos

¿Son los coeficientes diferentes de cero?

import scipy.stats as st

t_ho = 0

t1 = (0.4368-t_ho)/ 0.078

(1-st.t.cdf(t1,df = 53))

3.8888077047438685e-07

t_ho = 0.3

t1 = (0.4368-t_ho)/ 0.078

(1-st.t.cdf(np.abs(t1),df = 53))

0.04261898819196597

Interpretación de los coeficientes

El coeficiente de la variable dependiente mide la tasa de cambio (derivada=pendiente) del modelo

La interpretación suele ser En promedio, el aumento de una unidad en la variable independiente produce un aumento/disminución de \(\beta_i\) cantidad en la variable dependiente

Interprete la regresión anterior.

6.1.2. Práctica: Paridad del poder de compra#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Tabla5_9.csv"

datos = pd.read_csv(uu,sep = ';')

datos.head()

| COUNTRY | BMACLC | BMAC$ | EXCH | PPP | LOCALC | |

|---|---|---|---|---|---|---|

| 0 | United States | 2.54 | 2.54 | -99999.00 | -99999.00 | -99999 |

| 1 | Argentina | 2.50 | 2.50 | 1.00 | 0.98 | -40 |

| 2 | Australia | 3.00 | 1.52 | 1.98 | 1.18 | -35 |

| 3 | Brazil | 3.60 | 1.64 | 2.19 | 1.42 | -31 |

| 4 | Britain | 1.99 | 2.85 | 1.43 | 1.28 | 12 |

datos['EXCH'] = datos.EXCH.replace(to_replace= -99999, value=np.nan)

datos['PPP'] = datos.PPP.replace(to_replace = -99999, value = np.nan)

datos['LOCALC'] = datos.LOCALC.replace(to_replace= -99999, value = np.nan)

datos.head()

| COUNTRY | BMACLC | BMAC$ | EXCH | PPP | LOCALC | |

|---|---|---|---|---|---|---|

| 0 | United States | 2.54 | 2.54 | NaN | NaN | NaN |

| 1 | Argentina | 2.50 | 2.50 | 1.00 | 0.98 | -40.0 |

| 2 | Australia | 3.00 | 1.52 | 1.98 | 1.18 | -35.0 |

| 3 | Brazil | 3.60 | 1.64 | 2.19 | 1.42 | -31.0 |

| 4 | Britain | 1.99 | 2.85 | 1.43 | 1.28 | 12.0 |

Regresamos la paridad del poder de compra en la tasa de cambio

reg1 = stm.ols('EXCH~PPP',data = datos)

print(reg1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: EXCH R-squared: 0.987

Model: OLS Adj. R-squared: 0.986

Method: Least Squares F-statistic: 2066.

Date: Wed, 16 Apr 2025 Prob (F-statistic): 8.80e-28

Time: 04:04:58 Log-Likelihood: -205.44

No. Observations: 30 AIC: 414.9

Df Residuals: 28 BIC: 417.7

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -61.3889 44.987 -1.365 0.183 -153.541 30.763

PPP 1.8153 0.040 45.450 0.000 1.733 1.897

==============================================================================

Omnibus: 35.744 Durbin-Watson: 2.062

Prob(Omnibus): 0.000 Jarque-Bera (JB): 94.065

Skew: -2.585 Prob(JB): 3.75e-21

Kurtosis: 9.966 Cond. No. 1.18e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.18e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

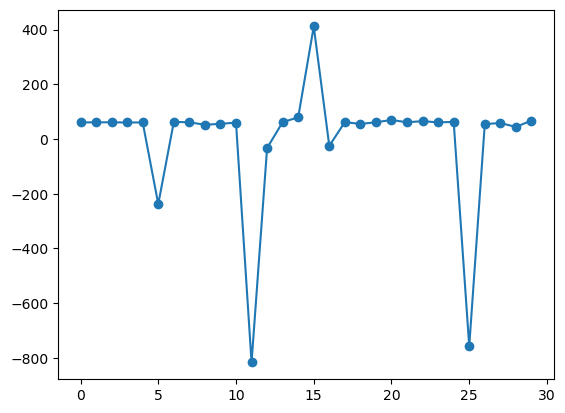

plt.figure()

plt.plot(np.arange(0,30),reg1.fit().resid,'-o')

[<matplotlib.lines.Line2D at 0x7fc1800ce0d0>]

reg3 = stm.ols('np.log(EXCH)~np.log(PPP)',data = datos)

print(reg3.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: np.log(EXCH) R-squared: 0.983

Model: OLS Adj. R-squared: 0.983

Method: Least Squares F-statistic: 1655.

Date: Wed, 16 Apr 2025 Prob (F-statistic): 1.87e-26

Time: 04:04:59 Log-Likelihood: -7.4056

No. Observations: 30 AIC: 18.81

Df Residuals: 28 BIC: 21.61

Df Model: 1

Covariance Type: nonrobust

===============================================================================

coef std err t P>|t| [0.025 0.975]

-------------------------------------------------------------------------------

Intercept 0.3436 0.086 3.990 0.000 0.167 0.520

np.log(PPP) 1.0023 0.025 40.688 0.000 0.952 1.053

==============================================================================

Omnibus: 2.829 Durbin-Watson: 1.629

Prob(Omnibus): 0.243 Jarque-Bera (JB): 1.449

Skew: -0.179 Prob(JB): 0.485

Kurtosis: 1.985 Cond. No. 5.38

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

La PPA sostiene que con una unidad de moneda debe ser posible comprar la misma canasta de bienes en todos los países.

6.1.3. Práctica: Sueño#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/sleep75.csv"

datos = pd.read_csv(uu,sep = ",",header=None)

datos.columns

datos.columns = ["age","black","case","clerical","construc","educ","earns74","gdhlth","inlf", "leis1", "leis2", "leis3", "smsa", "lhrwage", "lothinc", "male", "marr", "prot", "rlxall", "selfe", "sleep", "slpnaps", "south", "spsepay", "spwrk75", "totwrk" , "union" , "worknrm" , "workscnd", "exper" , "yngkid","yrsmarr", "hrwage", "agesq"]

#totwrk: minutos trabajados por semana

# sleep: minutos dormidos por semana

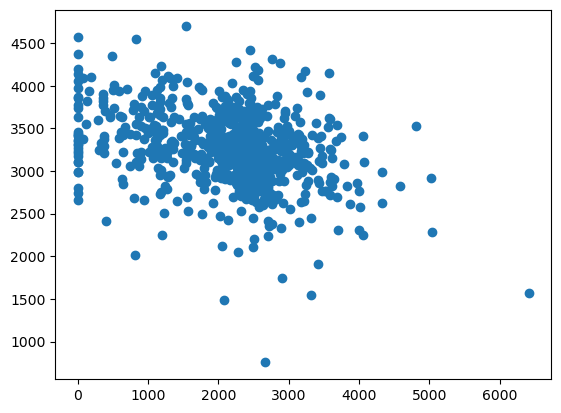

plt.figure()

plt.scatter(datos['totwrk'],datos['sleep'])

<matplotlib.collections.PathCollection at 0x7fc18005df10>

dormir = stm.ols('sleep~totwrk',data = datos)

print(dormir.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: sleep R-squared: 0.103

Model: OLS Adj. R-squared: 0.102

Method: Least Squares F-statistic: 81.09

Date: Wed, 16 Apr 2025 Prob (F-statistic): 1.99e-18

Time: 04:05:00 Log-Likelihood: -5267.1

No. Observations: 706 AIC: 1.054e+04

Df Residuals: 704 BIC: 1.055e+04

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 3586.3770 38.912 92.165 0.000 3509.979 3662.775

totwrk -0.1507 0.017 -9.005 0.000 -0.184 -0.118

==============================================================================

Omnibus: 68.651 Durbin-Watson: 1.955

Prob(Omnibus): 0.000 Jarque-Bera (JB): 192.044

Skew: -0.483 Prob(JB): 1.99e-42

Kurtosis: 5.365 Cond. No. 5.71e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 5.71e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

Para acceder a elementos de la estimación

print(dormir.fit().bse)

print(dormir.fit().params)

Intercept 38.912427

totwrk 0.016740

dtype: float64

Intercept 3586.376952

totwrk -0.150746

dtype: float64

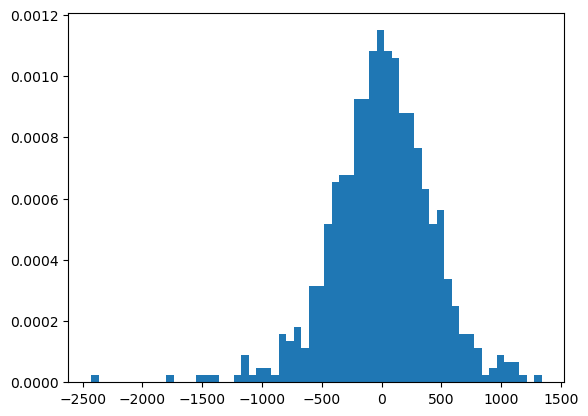

Intervalo de confianza para \(\beta_2\) y veamos los residuos

dormir.fit().params[1]+(-2*dormir.fit().bse[1],2*dormir.fit().bse[1])

array([-0.18422633, -0.11726532])

plt.figure()

plt.hist(dormir.fit().resid,bins = 60,density = True);

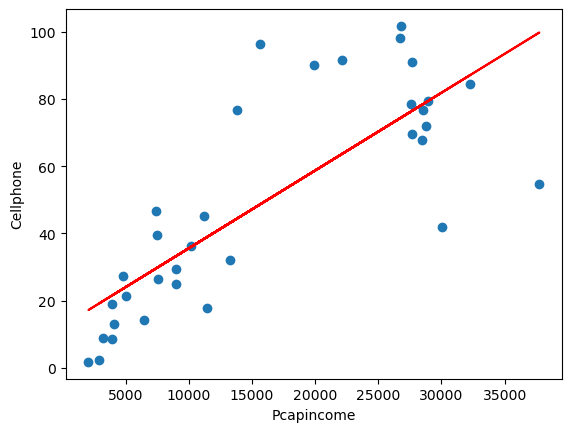

6.1.4. Transformaciones lineales#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Table%2031_3.csv"

datos = pd.read_csv(uu, sep =';')

reg_1 = stm.ols('Cellphone~Pcapincome',data = datos)

print(reg_1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: Cellphone R-squared: 0.626

Model: OLS Adj. R-squared: 0.615

Method: Least Squares F-statistic: 53.67

Date: Wed, 16 Apr 2025 Prob (F-statistic): 2.50e-08

Time: 04:05:01 Log-Likelihood: -148.94

No. Observations: 34 AIC: 301.9

Df Residuals: 32 BIC: 304.9

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 12.4795 6.109 2.043 0.049 0.037 24.922

Pcapincome 0.0023 0.000 7.326 0.000 0.002 0.003

==============================================================================

Omnibus: 1.398 Durbin-Watson: 2.381

Prob(Omnibus): 0.497 Jarque-Bera (JB): 0.531

Skew: 0.225 Prob(JB): 0.767

Kurtosis: 3.414 Cond. No. 3.46e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 3.46e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

plt.figure()

plt.plot(datos.Pcapincome,datos.Cellphone,'o')

plt.plot(datos.Pcapincome,reg_1.fit().fittedvalues,'-',color='r')

plt.xlabel('Pcapincome')

plt.ylabel('Cellphone')

Text(0, 0.5, 'Cellphone')

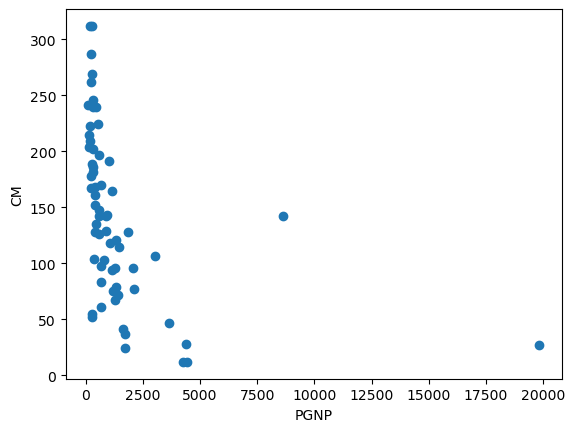

6.1.5. Modelo reciproco#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/tabla_6_4.csv"

datos = pd.read_csv(uu,sep = ';')

datos.describe()

| CM | FLR | PGNP | TFR | |

|---|---|---|---|---|

| count | 64.000000 | 64.000000 | 64.000000 | 64.000000 |

| mean | 141.500000 | 51.187500 | 1401.250000 | 5.549688 |

| std | 75.978067 | 26.007859 | 2725.695775 | 1.508993 |

| min | 12.000000 | 9.000000 | 120.000000 | 1.690000 |

| 25% | 82.000000 | 29.000000 | 300.000000 | 4.607500 |

| 50% | 138.500000 | 48.000000 | 620.000000 | 6.040000 |

| 75% | 192.500000 | 77.250000 | 1317.500000 | 6.615000 |

| max | 312.000000 | 95.000000 | 19830.000000 | 8.490000 |

plt.figure()

plt.plot(datos.PGNP,datos.CM,'o')

plt.xlabel('PGNP')

plt.ylabel('CM')

Text(0, 0.5, 'CM')

reg1 = stm.ols('CM~PGNP',data = datos)

print(reg1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: CM R-squared: 0.166

Model: OLS Adj. R-squared: 0.153

Method: Least Squares F-statistic: 12.36

Date: Wed, 16 Apr 2025 Prob (F-statistic): 0.000826

Time: 04:05:02 Log-Likelihood: -361.64

No. Observations: 64 AIC: 727.3

Df Residuals: 62 BIC: 731.6

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 157.4244 9.846 15.989 0.000 137.743 177.105

PGNP -0.0114 0.003 -3.516 0.001 -0.018 -0.005

==============================================================================

Omnibus: 3.321 Durbin-Watson: 1.931

Prob(Omnibus): 0.190 Jarque-Bera (JB): 2.545

Skew: 0.345 Prob(JB): 0.280

Kurtosis: 2.309 Cond. No. 3.43e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 3.43e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

datos['RepPGNP'] = 1/datos.PGNP

reg2 = stm.ols('CM~RepPGNP',data = datos)

print(reg2.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: CM R-squared: 0.459

Model: OLS Adj. R-squared: 0.450

Method: Least Squares F-statistic: 52.61

Date: Wed, 16 Apr 2025 Prob (F-statistic): 7.82e-10

Time: 04:05:02 Log-Likelihood: -347.79

No. Observations: 64 AIC: 699.6

Df Residuals: 62 BIC: 703.9

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 81.7944 10.832 7.551 0.000 60.141 103.447

RepPGNP 2.727e+04 3759.999 7.254 0.000 1.98e+04 3.48e+04

==============================================================================

Omnibus: 0.147 Durbin-Watson: 1.959

Prob(Omnibus): 0.929 Jarque-Bera (JB): 0.334

Skew: 0.065 Prob(JB): 0.846

Kurtosis: 2.671 Cond. No. 534.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

6.1.6. Modelo log-lineal#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/ceosal2.csv"

datos = pd.read_csv(uu,header = None)

datos.columns = ["salary", "age", "college", "grad", "comten", "ceoten", "sales", "profits","mktval", "lsalary", "lsales", "lmktval", "comtensq", "ceotensq", "profmarg"]

datos.head()

reg1 = stm.ols('lsalary~ceoten',data = datos)

print(reg1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lsalary R-squared: 0.013

Model: OLS Adj. R-squared: 0.008

Method: Least Squares F-statistic: 2.334

Date: Wed, 16 Apr 2025 Prob (F-statistic): 0.128

Time: 04:05:03 Log-Likelihood: -160.84

No. Observations: 177 AIC: 325.7

Df Residuals: 175 BIC: 332.0

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 6.5055 0.068 95.682 0.000 6.371 6.640

ceoten 0.0097 0.006 1.528 0.128 -0.003 0.022

==============================================================================

Omnibus: 3.858 Durbin-Watson: 2.084

Prob(Omnibus): 0.145 Jarque-Bera (JB): 3.907

Skew: -0.189 Prob(JB): 0.142

Kurtosis: 3.622 Cond. No. 16.1

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

6.1.7. Regresión a través del origen#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Table%206_1.csv"

datos = pd.read_csv(uu,sep = ';')

datos.head()

lmod1 = stm.ols('Y~ -1+X',data = datos)

print(lmod1.fit().summary())

OLS Regression Results

=======================================================================================

Dep. Variable: Y R-squared (uncentered): 0.502

Model: OLS Adj. R-squared (uncentered): 0.500

Method: Least Squares F-statistic: 241.2

Date: Wed, 16 Apr 2025 Prob (F-statistic): 4.41e-38

Time: 04:05:03 Log-Likelihood: -751.30

No. Observations: 240 AIC: 1505.

Df Residuals: 239 BIC: 1508.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

X 1.1555 0.074 15.532 0.000 1.009 1.302

==============================================================================

Omnibus: 9.576 Durbin-Watson: 1.973

Prob(Omnibus): 0.008 Jarque-Bera (JB): 13.569

Skew: -0.268 Prob(JB): 0.00113

Kurtosis: 4.034 Cond. No. 1.00

==============================================================================

Notes:

[1] R² is computed without centering (uncentered) since the model does not contain a constant.

[2] Standard Errors assume that the covariance matrix of the errors is correctly specified.

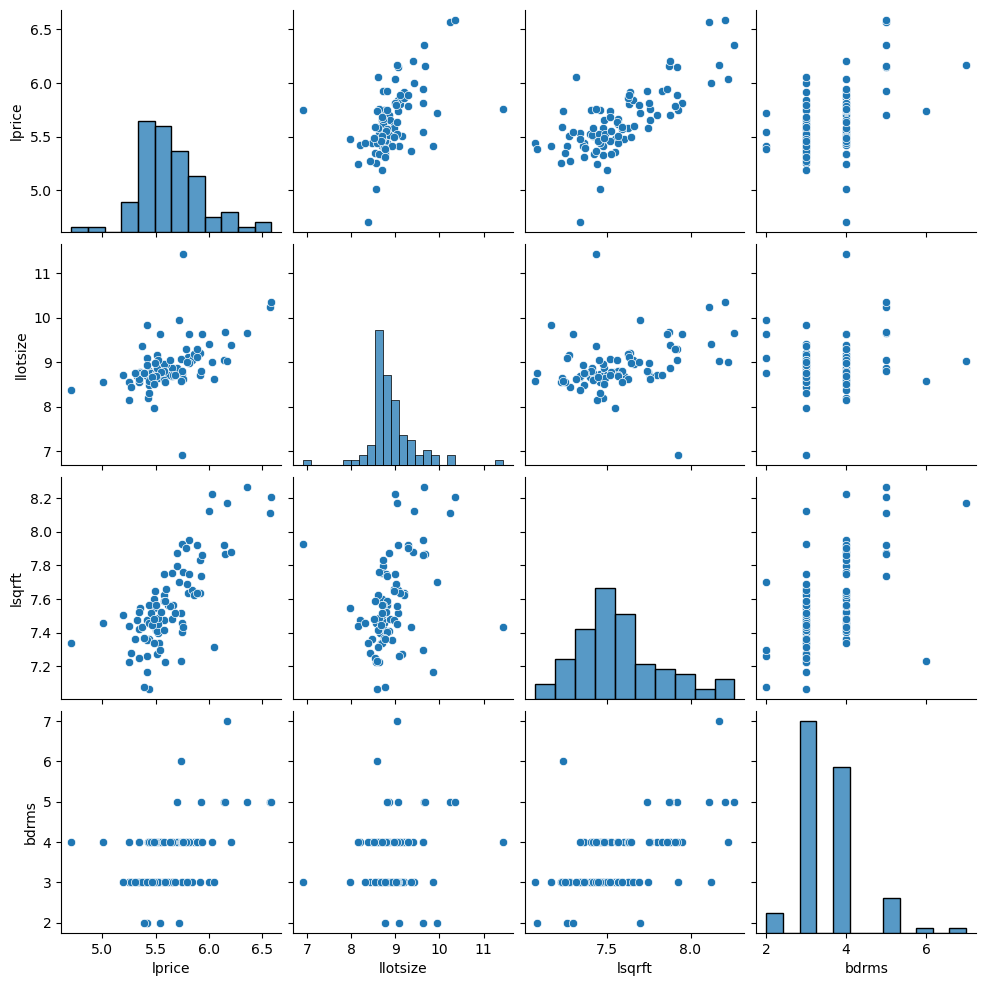

6.2. Regresión Lineal Múltiple#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/hprice1.csv"

datos = pd.read_csv(uu,header=None)

datos.columns = ["price" , "assess" ,

"bdrms" , "lotsize" ,

"sqrft" , "colonial",

"lprice" , "lassess" ,

"llotsize" , "lsqrft"]

datos.describe()

| price | assess | bdrms | lotsize | sqrft | colonial | lprice | lassess | llotsize | lsqrft | |

|---|---|---|---|---|---|---|---|---|---|---|

| count | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 |

| mean | 293.546034 | 315.736364 | 3.568182 | 9019.863636 | 2013.693182 | 0.693182 | 5.633180 | 5.717994 | 8.905105 | 7.572610 |

| std | 102.713445 | 95.314437 | 0.841393 | 10174.150414 | 577.191583 | 0.463816 | 0.303573 | 0.262113 | 0.544060 | 0.258688 |

| min | 111.000000 | 198.700000 | 2.000000 | 1000.000000 | 1171.000000 | 0.000000 | 4.709530 | 5.291796 | 6.907755 | 7.065613 |

| 25% | 230.000000 | 253.900000 | 3.000000 | 5732.750000 | 1660.500000 | 0.000000 | 5.438079 | 5.536940 | 8.653908 | 7.414873 |

| 50% | 265.500000 | 290.200000 | 3.000000 | 6430.000000 | 1845.000000 | 1.000000 | 5.581613 | 5.670566 | 8.768719 | 7.520231 |

| 75% | 326.250000 | 352.125000 | 4.000000 | 8583.250000 | 2227.000000 | 1.000000 | 5.787642 | 5.863982 | 9.057567 | 7.708266 |

| max | 725.000000 | 708.600000 | 7.000000 | 92681.000000 | 3880.000000 | 1.000000 | 6.586172 | 6.563291 | 11.436920 | 8.263591 |

modelo1 = stm.ols('lprice~lassess+llotsize+lsqrft+bdrms',data = datos)

print(modelo1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lprice R-squared: 0.773

Model: OLS Adj. R-squared: 0.762

Method: Least Squares F-statistic: 70.58

Date: Wed, 16 Apr 2025 Prob (F-statistic): 6.45e-26

Time: 04:05:04 Log-Likelihood: 45.750

No. Observations: 88 AIC: -81.50

Df Residuals: 83 BIC: -69.11

Df Model: 4

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 0.2637 0.570 0.463 0.645 -0.869 1.397

lassess 1.0431 0.151 6.887 0.000 0.742 1.344

llotsize 0.0074 0.039 0.193 0.848 -0.069 0.084

lsqrft -0.1032 0.138 -0.746 0.458 -0.379 0.172

bdrms 0.0338 0.022 1.531 0.129 -0.010 0.078

==============================================================================

Omnibus: 14.527 Durbin-Watson: 2.048

Prob(Omnibus): 0.001 Jarque-Bera (JB): 56.436

Skew: 0.118 Prob(JB): 5.56e-13

Kurtosis: 6.916 Cond. No. 501.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

modelo2 = stm.ols('lprice~llotsize+lsqrft+bdrms',data = datos)

print(modelo2.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lprice R-squared: 0.643

Model: OLS Adj. R-squared: 0.630

Method: Least Squares F-statistic: 50.42

Date: Wed, 16 Apr 2025 Prob (F-statistic): 9.74e-19

Time: 04:05:04 Log-Likelihood: 25.861

No. Observations: 88 AIC: -43.72

Df Residuals: 84 BIC: -33.81

Df Model: 3

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -1.2970 0.651 -1.992 0.050 -2.592 -0.002

llotsize 0.1680 0.038 4.388 0.000 0.092 0.244

lsqrft 0.7002 0.093 7.540 0.000 0.516 0.885

bdrms 0.0370 0.028 1.342 0.183 -0.018 0.092

==============================================================================

Omnibus: 12.060 Durbin-Watson: 2.089

Prob(Omnibus): 0.002 Jarque-Bera (JB): 34.890

Skew: -0.188 Prob(JB): 2.65e-08

Kurtosis: 6.062 Cond. No. 410.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

modelo3 = stm.ols('lprice~bdrms',data = datos)

print(modelo3.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lprice R-squared: 0.215

Model: OLS Adj. R-squared: 0.206

Method: Least Squares F-statistic: 23.53

Date: Wed, 16 Apr 2025 Prob (F-statistic): 5.43e-06

Time: 04:05:04 Log-Likelihood: -8.8147

No. Observations: 88 AIC: 21.63

Df Residuals: 86 BIC: 26.58

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 5.0365 0.126 39.862 0.000 4.785 5.288

bdrms 0.1672 0.034 4.851 0.000 0.099 0.236

==============================================================================

Omnibus: 7.476 Durbin-Watson: 2.056

Prob(Omnibus): 0.024 Jarque-Bera (JB): 13.085

Skew: -0.182 Prob(JB): 0.00144

Kurtosis: 4.854 Cond. No. 17.2

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

import seaborn as sns

sns.pairplot(datos.loc[:,['lprice','llotsize' , 'lsqrft' , 'bdrms']])

<seaborn.axisgrid.PairGrid at 0x7fc180367df0>

6.2.1. Predicción#

datos_nuevos = pd.DataFrame({'llotsize':np.log(2100),'lsqrft':np.log(8000),'bdrms':4},index = [0])

pred_vals = modelo2.fit().predict()

modelo2.fit().get_prediction().summary_frame().head()

| mean | mean_se | mean_ci_lower | mean_ci_upper | obs_ci_lower | obs_ci_upper | |

|---|---|---|---|---|---|---|

| 0 | 5.776577 | 0.029185 | 5.718541 | 5.834614 | 5.404916 | 6.148239 |

| 1 | 5.707740 | 0.029306 | 5.649463 | 5.766018 | 5.336041 | 6.079440 |

| 2 | 5.310543 | 0.033384 | 5.244156 | 5.376930 | 4.937486 | 5.683600 |

| 3 | 5.326681 | 0.031818 | 5.263407 | 5.389955 | 4.954165 | 5.699197 |

| 4 | 5.797220 | 0.031014 | 5.735544 | 5.858895 | 5.424972 | 6.169467 |

pred_vals = modelo2.fit().get_prediction(datos_nuevos)

pred_vals.summary_frame()

| mean | mean_se | mean_ci_lower | mean_ci_upper | obs_ci_lower | obs_ci_upper | |

|---|---|---|---|---|---|---|

| 0 | 6.428811 | 0.147975 | 6.134546 | 6.723076 | 5.958326 | 6.899296 |

6.2.2. RLM: Cobb-Douglas#

El modelo:

donde

\(Y\): producción

\(X_2\): insumo trabajo

\(X_3\): insumo capital

\(u\): término de perturbación

\(e\): base del logaritmo

Notemos que el modelo es multiplicativo, si tomamos la derivada obetenemos un modelo más famliar respecto a la regresión lineal múltiple:

La interpretación de los coeficientes es []:

\(\beta_2\) es la elasticidad (parcial) de la producción respecto del insumo trabajo, es decir, mide el cambio porcentual en la producción debido a una variación de 1% en el insumo trabajo, con el insumo capital constante.

De igual forma, \(\beta_3\) es la elasticidad (parcial) de la producción respecto del insumo capital, con el insumo trabajo constante.

La suma (\(\beta_2+\beta_3\)) da información sobre los rendimientos a escala, es decir, la respuesta de la producción a un cambio proporcional en los insumos. Si esta suma es 1, existen rendimientos constantes a escala, es decir, la duplicación de los insumos duplica la producción, la triplicación de los insumos la triplica, y así sucesivamente. Si la suma es menor que 1, existen rendimientos decrecientes a escala: al duplicar los insumos, la producción crece en menos del doble. Por último, si la suma es mayor que 1, hay rendimientos crecientes a escala; la duplicación de los insumos aumenta la producción en más del doble.

Abrir la tabla 7.3. Regresar las horas de trabajo (\(X_2\)) e Inversión de Capital (\(X_3\)) en el Valor Agregado (\(Y\))

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/tabla7_3.csv"

datos = pd.read_csv(uu,sep=";")

datos.describe()

| Year | Y | X2 | X3 | |

|---|---|---|---|---|

| count | 15.000000 | 15.000000 | 15.000000 | 15.000000 |

| mean | 1965.000000 | 24735.333333 | 287.346667 | 25505.966667 |

| std | 4.472136 | 4874.173486 | 14.806556 | 7334.889966 |

| min | 1958.000000 | 16607.700000 | 267.000000 | 17803.700000 |

| 25% | 1961.500000 | 20618.800000 | 274.700000 | 19407.450000 |

| 50% | 1965.000000 | 26465.800000 | 288.100000 | 23445.200000 |

| 75% | 1968.500000 | 28832.100000 | 299.850000 | 30766.850000 |

| max | 1972.000000 | 31535.800000 | 307.500000 | 41794.300000 |

W = np.log(datos.X2)

K = np.log(datos.X3)

LY = np.log(datos.Y)

reg_1 = stm.ols("LY~W+K",data = datos).fit()

print(reg_1.summary())

import statsmodels.api as sm

sm.stats.anova_lm(reg_1, typ=2)

/Users/victormorales/opt/anaconda3/lib/python3.9/site-packages/scipy/stats/_stats_py.py:1806: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=15

warnings.warn("kurtosistest only valid for n>=20 ... continuing "

OLS Regression Results

==============================================================================

Dep. Variable: LY R-squared: 0.889

Model: OLS Adj. R-squared: 0.871

Method: Least Squares F-statistic: 48.08

Date: Wed, 16 Apr 2025 Prob (F-statistic): 1.86e-06

Time: 04:05:08 Log-Likelihood: 19.284

No. Observations: 15 AIC: -32.57

Df Residuals: 12 BIC: -30.44

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -3.3387 2.449 -1.363 0.198 -8.675 1.998

W 1.4987 0.540 2.777 0.017 0.323 2.675

K 0.4899 0.102 4.801 0.000 0.268 0.712

==============================================================================

Omnibus: 3.290 Durbin-Watson: 0.891

Prob(Omnibus): 0.193 Jarque-Bera (JB): 1.723

Skew: -0.827 Prob(JB): 0.422

Kurtosis: 3.141 Cond. No. 1.51e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.51e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

| sum_sq | df | F | PR(>F) | |

|---|---|---|---|---|

| W | 0.043141 | 1.0 | 7.710533 | 0.016750 |

| K | 0.128988 | 1.0 | 23.053747 | 0.000432 |

| Residual | 0.067141 | 12.0 | NaN | NaN |

Las elasticidades de la producción respecto del trabajo y el capital fueron 1.49 y 0.48 respectivamente.

Ahora, si existen rendimientos constantes a escala (un cambio equi-proporcional en la producción ante un cambio equi-proporcional en los insumos), la teoría económica sugeriría que:

LY_K = np.log(datos.Y/datos.X3)

W_K = np.log(datos.X2/datos.X3)

reg_2 = stm.ols("LY_K~W_K",data = datos).fit()

print(reg_2.summary())

sm.stats.anova_lm(reg_2)

OLS Regression Results

==============================================================================

Dep. Variable: LY_K R-squared: 0.570

Model: OLS Adj. R-squared: 0.536

Method: Least Squares F-statistic: 17.20

Date: Wed, 16 Apr 2025 Prob (F-statistic): 0.00115

Time: 04:05:09 Log-Likelihood: 16.965

No. Observations: 15 AIC: -29.93

Df Residuals: 13 BIC: -28.51

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 1.7083 0.416 4.108 0.001 0.810 2.607

W_K 0.3870 0.093 4.147 0.001 0.185 0.589

==============================================================================

Omnibus: 0.801 Durbin-Watson: 0.601

Prob(Omnibus): 0.670 Jarque-Bera (JB): 0.749

Skew: -0.431 Prob(JB): 0.688

Kurtosis: 2.325 Cond. No. 89.9

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

/Users/victormorales/opt/anaconda3/lib/python3.9/site-packages/scipy/stats/_stats_py.py:1806: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=15

warnings.warn("kurtosistest only valid for n>=20 ... continuing "

| df | sum_sq | mean_sq | F | PR(>F) | |

|---|---|---|---|---|---|

| W_K | 1.0 | 0.121005 | 0.121005 | 17.19981 | 0.001147 |

| Residual | 13.0 | 0.091459 | 0.007035 | NaN | NaN |

¿Se cumple la hipótesis nula? ¿Existen rendimientos constantes de escala?

Una forma de responder a la pregunta es mediante la prueba \(t\), para \(Ho: \beta_2 +\beta_3 = 1\), tenemos

donde la información nececesaria para obtener \(cov(\hat{\beta}_2,\hat{\beta}_3)\) en Python la librería statsmodels.api es model.cov_params() y model es el ajuste del modelo.

Otra forma de hacer la prueba es mediante el estadístico \(F\):

donde \(m\) es el número de restricciones lineales y \(k\) es el número de parámetros de la regresión no restringida.

SCRNR = 0.0671410

SCRRes = 0.09145854

numero_rest = 1

grad = 12

est_F = ((SCRRes-SCRNR)/numero_rest)/(SCRNR/grad)

est_F

from scipy import stats

mif = stats.f.cdf(est_F,dfn=1, dfd=12)

valorp = 1-mif

print(["Estadistico F: "] +[est_F])

print(["Valor p: "] +[valorp])

#cov_matrix = reg_1.cov_params()

#print(cov_matrix)

['Estadistico F: ', 4.346233746890871]

['Valor p: ', 0.059121842231030675]

No se tiene suficiente evidencia para rechazar la hipótesis nula de que sea una economía de escala.

Notemos que existe una relación directa entre el coeficiente de determinación o bondad de ajuste \(R^2\) y \(F\). En primero lugar, recordemos la descomposición de los errores:

De cuyos elementos podemos obtener tanto \(R^2\) como \(F\):

donde \(k\) es el número de variables (incluido el intercepto) y sigue una distribución \(F\) con \(k-1\) y \(n-k\) grados de libertad.

6.2.3. RLM: Dicotómicas#

Abrir los datos wage1 Correr los modelos. Se desea saber si el género tiene relación con el salario y en qué medida.

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/wage1.csv"

salarios = pd.read_csv(uu, header = None)

salarios.columns = ["wage", "educ", "exper", "tenure", "nonwhite", "female", "married",

"numdep", "smsa", "northcen", "south", "west", "construc", "ndurman",

"trcommpu", "trade", "services", "profserv", "profocc", "clerocc",

"servocc", "lwage", "expersq", "tenursq"]

reg3 = stm.ols("wage~female",data = salarios).fit()

print(reg3.summary())

reg4 = stm.ols("wage~female + educ+ exper + tenure",data = salarios).fit()

print(reg4.summary())

OLS Regression Results

==============================================================================

Dep. Variable: wage R-squared: 0.116

Model: OLS Adj. R-squared: 0.114

Method: Least Squares F-statistic: 68.54

Date: Wed, 16 Apr 2025 Prob (F-statistic): 1.04e-15

Time: 04:05:09 Log-Likelihood: -1400.7

No. Observations: 526 AIC: 2805.

Df Residuals: 524 BIC: 2814.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 7.0995 0.210 33.806 0.000 6.687 7.512

female -2.5118 0.303 -8.279 0.000 -3.108 -1.916

==============================================================================

Omnibus: 223.488 Durbin-Watson: 1.818

Prob(Omnibus): 0.000 Jarque-Bera (JB): 929.998

Skew: 1.928 Prob(JB): 1.13e-202

Kurtosis: 8.250 Cond. No. 2.57

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

OLS Regression Results

==============================================================================

Dep. Variable: wage R-squared: 0.364

Model: OLS Adj. R-squared: 0.359

Method: Least Squares F-statistic: 74.40

Date: Wed, 16 Apr 2025 Prob (F-statistic): 7.30e-50

Time: 04:05:09 Log-Likelihood: -1314.2

No. Observations: 526 AIC: 2638.

Df Residuals: 521 BIC: 2660.

Df Model: 4

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -1.5679 0.725 -2.164 0.031 -2.991 -0.145

female -1.8109 0.265 -6.838 0.000 -2.331 -1.291

educ 0.5715 0.049 11.584 0.000 0.475 0.668

exper 0.0254 0.012 2.195 0.029 0.003 0.048

tenure 0.1410 0.021 6.663 0.000 0.099 0.183

==============================================================================

Omnibus: 185.864 Durbin-Watson: 1.794

Prob(Omnibus): 0.000 Jarque-Bera (JB): 715.580

Skew: 1.589 Prob(JB): 4.11e-156

Kurtosis: 7.749 Cond. No. 141.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

La hipótesis es saber si el coeficiente de female es menor a cero.

Se nota que es menor.

Tomando en cuenta, educacion experiencia y edad, en promedio a la mujer le pagan 1.81 menos

6.2.4. RLM: Educación con insumos#

Abrir los datos gpa1 Correr los modelos.

¿Afecta el promedio de calificaciones el tener o no una computadora?

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/gpa1.csv"

datosgpa = pd.read_csv(uu, header = None)

datosgpa.columns = ["age", "soph", "junior", "senior", "senior5", "male", "campus", "business", "engineer", "colGPA", "hsGPA", "ACT", "job19", "job20", "drive", "bike", "walk", "voluntr", "PC", "greek", "car", "siblings", "bgfriend", "clubs", "skipped", "alcohol", "gradMI", "fathcoll", "mothcoll"]

reg4 = stm.ols('colGPA ~ PC', data = datosgpa)

print(reg4.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: colGPA R-squared: 0.050

Model: OLS Adj. R-squared: 0.043

Method: Least Squares F-statistic: 7.314

Date: Wed, 16 Apr 2025 Prob (F-statistic): 0.00770

Time: 04:05:10 Log-Likelihood: -56.641

No. Observations: 141 AIC: 117.3

Df Residuals: 139 BIC: 123.2

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 2.9894 0.040 75.678 0.000 2.911 3.068

PC 0.1695 0.063 2.704 0.008 0.046 0.293

==============================================================================

Omnibus: 2.136 Durbin-Watson: 1.941

Prob(Omnibus): 0.344 Jarque-Bera (JB): 1.852

Skew: 0.160 Prob(JB): 0.396

Kurtosis: 2.539 Cond. No. 2.45

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

reg5 = stm.ols('colGPA ~ PC + hsGPA + ACT', data = datosgpa)

print(reg5.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: colGPA R-squared: 0.219

Model: OLS Adj. R-squared: 0.202

Method: Least Squares F-statistic: 12.83

Date: Wed, 16 Apr 2025 Prob (F-statistic): 1.93e-07

Time: 04:05:10 Log-Likelihood: -42.796

No. Observations: 141 AIC: 93.59

Df Residuals: 137 BIC: 105.4

Df Model: 3

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 1.2635 0.333 3.793 0.000 0.605 1.922

PC 0.1573 0.057 2.746 0.007 0.044 0.271

hsGPA 0.4472 0.094 4.776 0.000 0.262 0.632

ACT 0.0087 0.011 0.822 0.413 -0.012 0.029

==============================================================================

Omnibus: 2.770 Durbin-Watson: 1.870

Prob(Omnibus): 0.250 Jarque-Bera (JB): 1.863

Skew: 0.016 Prob(JB): 0.394

Kurtosis: 2.438 Cond. No. 298.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

6.2.5. RLM: Cambio estructural#

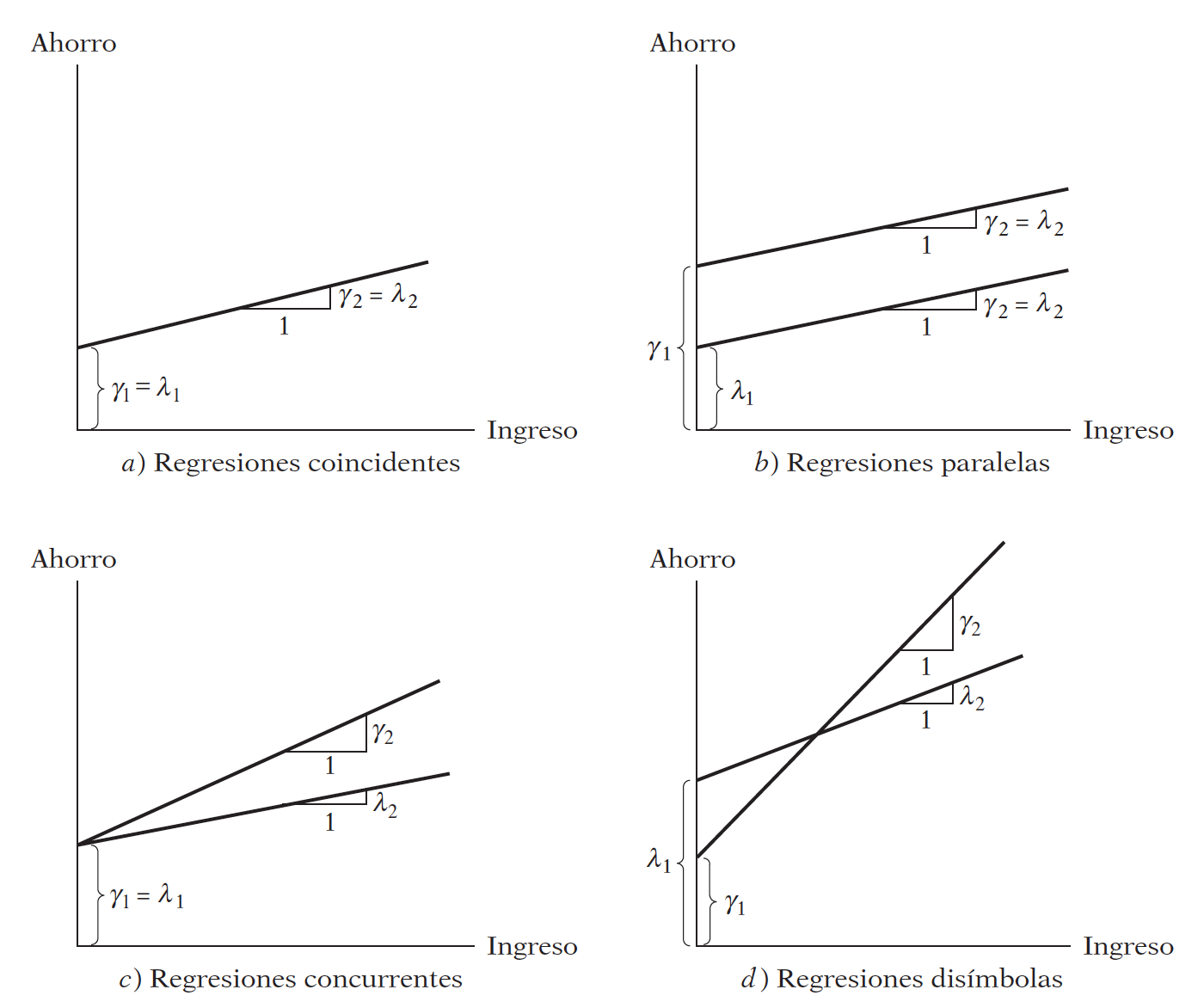

Cuando utilizamos un modelo de regresión que implica series de tiempo, tal vez se dé un cambio estructural en la relación entre la regresada Y y las regresoras. Por cambio estructural nos referimos a que los valores de los parámetros del modelo no permanecen constantes a lo largo de todo el periodo []

Se sabe muy bien que en 1982 Estados Unidos experimentó su peor recesión en tiempos de paz. La tasa de desempleo civil alcanzó 9.7%, la más alta desde 1948. Un suceso como éste pudo perturbar la relación entre el ahorro y el IPD. Para ver si lo anterior sucedió, dividamos la muestra en dos periodos: 1970-1981 y 1982-1995, antes y después de la recesión de 1982.

Ahora tenemos tres posibles regresiones:

De los períodos parciales se desprende cuatro posibilidades:

Para evaluar si hay diferencias, podemos utilizar los modelos de regresión con variables dicotómicas:

donde

\(Y\): ahorro

\(X\): ingreso

\(t\): tiempo

\(D\): 1 para el período 1982-1995, 0 en otro caso.

La variable dicotómica de la ecuación (6.3) es quien me permite estimar las ecuaciones (6.1) y (6.2) al mismo tiempo. Es decir:

Función de ahorros medios para 1970-1981:

Función de ahorros medios para 1982-1995:

Notemos que se trata de las mismas funciones que en (6.1) y (6.2), con

\(\lambda_1=\alpha_1\)

\(\lambda_2=\beta_1\)

\(\gamma_1=(\alpha_1+\alpha_2)\)

\(\gamma_2=(\beta_1+\beta_2)\)

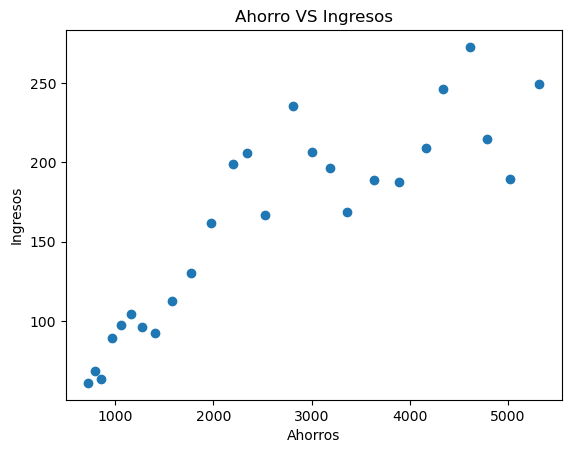

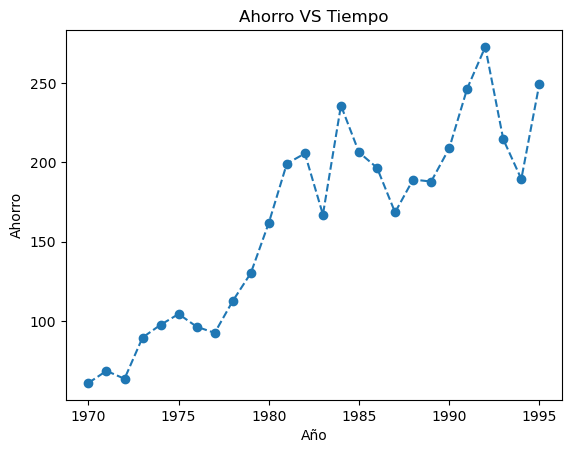

Abrir los datos 8.9. Veamos las variables gráficamente:

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/tabla_8_9.csv"

datos = pd.read_csv(uu,sep=";")

datos.columns

Index(['YEAR', 'SAVINGS', 'INCOME'], dtype='object')

import matplotlib.pyplot as plt

plt.scatter(datos.INCOME,datos.SAVINGS)

plt.gca().update(dict(title='Ahorro VS Ingresos', xlabel='Ahorros', ylabel='Ingresos'))

[Text(0.5, 1.0, 'Ahorro VS Ingresos'),

Text(0.5, 0, 'Ahorros'),

Text(0, 0.5, 'Ingresos')]

plt.plot(datos.YEAR,datos.SAVINGS,"--o")

plt.gca().update(dict(title='Ahorro VS Tiempo', xlabel='Año', ylabel='Ahorro'))

[Text(0.5, 1.0, 'Ahorro VS Tiempo'),

Text(0.5, 0, 'Año'),

Text(0, 0.5, 'Ahorro')]

¿Hubo algún cambio en la relación entre ingreso y ahorro en el 80?

Hay varias formas de hacer la prueba, la mas fácil es mediante variables dicotómicas

ajuste_chow = stm.ols("SAVINGS~INCOME",data = datos).fit()

print(ajuste_chow.summary())

cambio = (datos.YEAR>1981)*1

ajuste_chow = stm.ols("SAVINGS~INCOME+cambio",data = datos).fit()

print(ajuste_chow.summary())

OLS Regression Results

==============================================================================

Dep. Variable: SAVINGS R-squared: 0.767

Model: OLS Adj. R-squared: 0.758

Method: Least Squares F-statistic: 79.10

Date: Wed, 16 Apr 2025 Prob (F-statistic): 4.61e-09

Time: 04:05:10 Log-Likelihood: -125.24

No. Observations: 26 AIC: 254.5

Df Residuals: 24 BIC: 257.0

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 62.4227 12.761 4.892 0.000 36.086 88.760

INCOME 0.0377 0.004 8.894 0.000 0.029 0.046

==============================================================================

Omnibus: 1.662 Durbin-Watson: 0.860

Prob(Omnibus): 0.436 Jarque-Bera (JB): 1.171

Skew: 0.515 Prob(JB): 0.557

Kurtosis: 2.863 Cond. No. 6.30e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 6.3e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

OLS Regression Results

==============================================================================

Dep. Variable: SAVINGS R-squared: 0.792

Model: OLS Adj. R-squared: 0.774

Method: Least Squares F-statistic: 43.76

Date: Wed, 16 Apr 2025 Prob (F-statistic): 1.45e-08

Time: 04:05:10 Log-Likelihood: -123.78

No. Observations: 26 AIC: 253.6

Df Residuals: 23 BIC: 257.3

Df Model: 2

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 71.7059 13.546 5.294 0.000 43.685 99.727

INCOME 0.0265 0.008 3.340 0.003 0.010 0.043

cambio 37.8335 22.905 1.652 0.112 -9.549 85.216

==============================================================================

Omnibus: 2.327 Durbin-Watson: 1.046

Prob(Omnibus): 0.312 Jarque-Bera (JB): 1.671

Skew: 0.619 Prob(JB): 0.434

Kurtosis: 2.899 Cond. No. 1.22e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.22e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

Veamos el modelo en términos de interacciones y la matriz de diseño:

ajuste_chow1 = stm.ols("SAVINGS~INCOME+cambio+INCOME*cambio", data = datos).fit()

print(ajuste_chow1.summary())

OLS Regression Results

==============================================================================

Dep. Variable: SAVINGS R-squared: 0.882

Model: OLS Adj. R-squared: 0.866

Method: Least Squares F-statistic: 54.78

Date: Wed, 16 Apr 2025 Prob (F-statistic): 2.27e-10

Time: 04:05:10 Log-Likelihood: -116.41

No. Observations: 26 AIC: 240.8

Df Residuals: 22 BIC: 245.9

Df Model: 3

Covariance Type: nonrobust

=================================================================================

coef std err t P>|t| [0.025 0.975]

---------------------------------------------------------------------------------

Intercept 1.0161 20.165 0.050 0.960 -40.803 42.835

INCOME 0.0803 0.014 5.541 0.000 0.050 0.110

cambio 152.4786 33.082 4.609 0.000 83.870 221.087

INCOME:cambio -0.0655 0.016 -4.096 0.000 -0.099 -0.032

==============================================================================

Omnibus: 0.861 Durbin-Watson: 1.648

Prob(Omnibus): 0.650 Jarque-Bera (JB): 0.596

Skew: 0.360 Prob(JB): 0.742

Kurtosis: 2.822 Cond. No. 3.24e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 3.24e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

6.3. RLM: Supuestos#

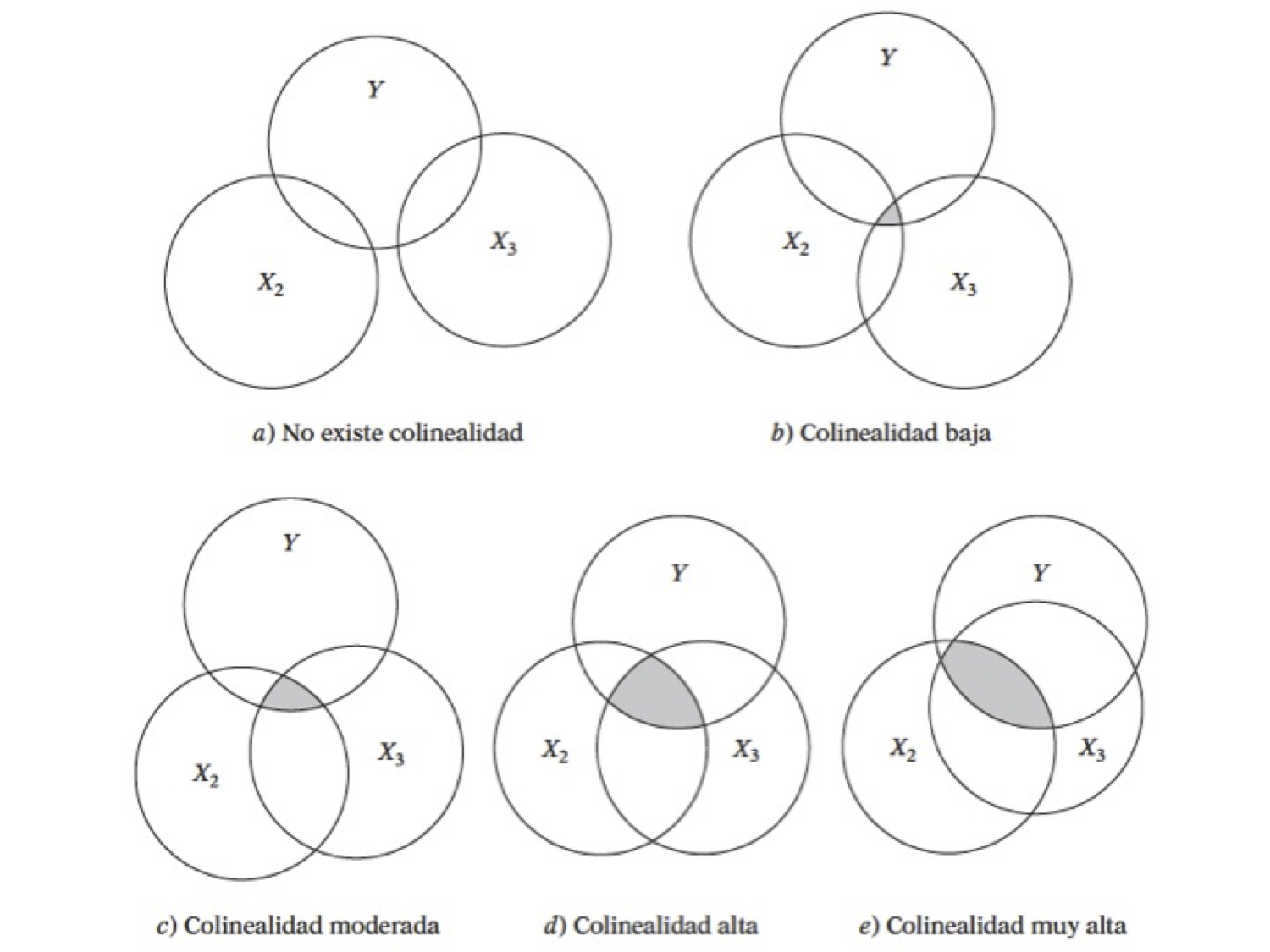

6.3.1. Multicolinealidad#

El problema:

Se tiene un problema en cuanto a la transpuesta de la matriz \((X'X)\)

Perfecta: Si se tiene este tipo, el modelo simplemente no toma en cuenta esta variable

Imperfecta: El cáclulo de la inversa es computacionalmente exigente

Posibles causas:

El método de recolección de información

Restricciones en el modelo o en la población objeto de muestreo

Especificación del modelo

Un modelo sobredetermindado

Series de tiempo

¿Cuál es la naturaleza de la multicolinealidad?

Causas

¿Cuáles son sus consecuencias prácticas?

Incidencia en los errores estándar y sensibilidad

¿Cómo se detecta?

Pruebas

¿Qué medidas pueden tomarse para aliviar el problema de multicolinealidad?

No hacer nada

Eliminar variables

Transformación de variables

Añadir datos a la muestra

Componentes principales, factores, entre otros

¿Cómo se detecta?

Un \(R^{2}\) elevado pero con pocas razones \(t\) significativas

Regresiones auxiliares (Pruebas de Klein)

Factor de inflación de la varianza

Ejemplo 1

Haremos uso del paquete AER

Abrir la tabla 10.8

Ajusta el modelo

donde

\(X_1\) índice implícito de deflación de precios para el PIB,

\(X_2\) es el PIB (en millones de dólares),

\(X_3\) número de desempleados (en miles),

\(X_4\) número de personas enlistadas en las fuerzas armadas,

\(X_5\) población no institucionalizada mayor de 14 años de edad

\(X_6\) año (igual a 1 para 1947, 2 para 1948 y 16 para 1962).

Analice los resultados

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/tabla10_8.csv"

datos = pd.read_csv(uu,sep = ";")

datos.describe()

| obs | Y | X1 | X2 | X3 | X4 | X5 | TIME | |

|---|---|---|---|---|---|---|---|---|

| count | 15.000000 | 15.000000 | 15.000000 | 15.000000 | 15.000000 | 15.000000 | 15.000000 | 15.000000 |

| mean | 1954.000000 | 64968.066667 | 1006.666667 | 376552.066667 | 3139.066667 | 2592.000000 | 116580.200000 | 8.000000 |

| std | 4.472136 | 3335.820235 | 103.503393 | 91951.976996 | 940.825053 | 717.773741 | 6295.863769 | 4.472136 |

| min | 1947.000000 | 60171.000000 | 830.000000 | 234289.000000 | 1870.000000 | 1456.000000 | 107608.000000 | 1.000000 |

| 25% | 1950.500000 | 62204.000000 | 928.500000 | 306787.000000 | 2340.500000 | 2082.000000 | 111502.000000 | 4.500000 |

| 50% | 1954.000000 | 64989.000000 | 1000.000000 | 365385.000000 | 2936.000000 | 2637.000000 | 116219.000000 | 8.000000 |

| 75% | 1957.500000 | 68013.000000 | 1096.000000 | 443657.500000 | 3747.500000 | 3073.500000 | 121197.500000 | 11.500000 |

| max | 1961.000000 | 69564.000000 | 1157.000000 | 518173.000000 | 4806.000000 | 3594.000000 | 127852.000000 | 15.000000 |

Agreguemos el tiempo:

Las correlaciones muy altas también suelen ser síntoma de multicolinealidad

ajuste2 = stm.ols("Y~X1+X2+X3+X4+X5+TIME",data = datos).fit()

print(ajuste2.summary())

OLS Regression Results

==============================================================================

Dep. Variable: Y R-squared: 0.996

Model: OLS Adj. R-squared: 0.992

Method: Least Squares F-statistic: 295.8

Date: Wed, 16 Apr 2025 Prob (F-statistic): 6.04e-09

Time: 04:05:11 Log-Likelihood: -101.91

No. Observations: 15 AIC: 217.8

Df Residuals: 8 BIC: 222.8

Df Model: 6

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 6.727e+04 2.32e+04 2.895 0.020 1.37e+04 1.21e+05

X1 -2.0511 8.710 -0.235 0.820 -22.136 18.034

X2 -0.0273 0.033 -0.824 0.434 -0.104 0.049

X3 -1.9523 0.477 -4.095 0.003 -3.052 -0.853

X4 -0.9582 0.216 -4.432 0.002 -1.457 -0.460

X5 0.0513 0.234 0.219 0.832 -0.488 0.591

TIME 1585.1555 482.683 3.284 0.011 472.086 2698.225

==============================================================================

Omnibus: 1.044 Durbin-Watson: 2.492

Prob(Omnibus): 0.593 Jarque-Bera (JB): 0.418

Skew: 0.408 Prob(JB): 0.811

Kurtosis: 2.929 Cond. No. 1.23e+08

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.23e+08. This might indicate that there are

strong multicollinearity or other numerical problems.

/Users/victormorales/opt/anaconda3/lib/python3.9/site-packages/scipy/stats/_stats_py.py:1806: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=15

warnings.warn("kurtosistest only valid for n>=20 ... continuing "

X = datos[['X1','X2','X3','X4','X5','TIME']]

np.corrcoef(X)

array([[1. , 0.99924002, 0.99943568, 0.99769462, 0.99320207,

0.99142138, 0.98987707, 0.99050446, 0.98686967, 0.98485669,

0.98283221, 0.98314407, 0.97959391, 0.97833135, 0.97770034],

[0.99924002, 1. , 0.9999722 , 0.99957845, 0.99697832,

0.99575407, 0.99464953, 0.99510499, 0.99241202, 0.99086331,

0.98927457, 0.98951979, 0.98668154, 0.98565615, 0.98514016],

[0.99943568, 0.9999722 , 1. , 0.99940088, 0.99649819,

0.99518861, 0.99401913, 0.99452176, 0.99168255, 0.99006487,

0.98841306, 0.9886863 , 0.98573357, 0.98467382, 0.98414795],

[0.99769462, 0.99957845, 0.99940088, 1. , 0.99878987,

0.99797718, 0.99719881, 0.99754083, 0.99554183, 0.99433745,

0.99307333, 0.99328088, 0.99096573, 0.99011719, 0.9896916 ],

[0.99320207, 0.99697832, 0.99649819, 0.99878987, 1. ,

0.99989587, 0.99966866, 0.99976654, 0.99895641, 0.99833471,

0.99761743, 0.99771787, 0.99631115, 0.99576088, 0.99547264],

[0.99142138, 0.99575407, 0.99518861, 0.99797718, 0.99989587,

1. , 0.99993547, 0.99996501, 0.9995048 , 0.99905523,

0.99849979, 0.99857166, 0.99743196, 0.99697003, 0.99672361],

[0.98987707, 0.99464953, 0.99401913, 0.99719881, 0.99966866,

0.99993547, 1. , 0.99997915, 0.99979584, 0.99948306,

0.99905612, 0.9991084 , 0.99817895, 0.99778718, 0.99757476],

[0.99050446, 0.99510499, 0.99452176, 0.99754083, 0.99976654,

0.99996501, 0.99997915, 1. , 0.99970179, 0.99933544,

0.9988595 , 0.99893769, 0.9979167 , 0.99749814, 0.99727928],

[0.98686967, 0.99241202, 0.99168255, 0.99554183, 0.99895641,

0.9995048 , 0.99979584, 0.99970179, 1. , 0.9999274 ,

0.99972691, 0.99975735, 0.99919068, 0.99892257, 0.9987745 ],

[0.98485669, 0.99086331, 0.99006487, 0.99433745, 0.99833471,

0.99905523, 0.99948306, 0.99933544, 0.9999274 , 1. ,

0.99993587, 0.99994535, 0.999602 , 0.9994084 , 0.99929635],

[0.98283221, 0.98927457, 0.98841306, 0.99307333, 0.99761743,

0.99849979, 0.99905612, 0.9988595 , 0.99972691, 0.99993587,

1. , 0.99999093, 0.99985693, 0.99973344, 0.99965577],

[0.98314407, 0.98951979, 0.9886863 , 0.99328088, 0.99771787,

0.99857166, 0.9991084 , 0.99893769, 0.99975735, 0.99994535,

0.99999093, 1. , 0.99982617, 0.99969251, 0.99961536],

[0.97959391, 0.98668154, 0.98573357, 0.99096573, 0.99631115,

0.99743196, 0.99817895, 0.9979167 , 0.99919068, 0.999602 ,

0.99985693, 0.99982617, 1. , 0.99998083, 0.99995641],

[0.97833135, 0.98565615, 0.98467382, 0.99011719, 0.99576088,

0.99697003, 0.99778718, 0.99749814, 0.99892257, 0.9994084 ,

0.99973344, 0.99969251, 0.99998083, 1. , 0.99999438],

[0.97770034, 0.98514016, 0.98414795, 0.9896916 , 0.99547264,

0.99672361, 0.99757476, 0.99727928, 0.9987745 , 0.99929635,

0.99965577, 0.99961536, 0.99995641, 0.99999438, 1. ]])

Prueba de Klein: Se basa en realizar regresiones auxiliares de todas contra todas las variables regresoras.

Si el \(R^{2}\) de la regresión aux es mayor que la global, esa variable regresora podría ser la que genera multicolinealidad

¿Cuántas regresiones auxiliares se tiene en un modelo en general?

Regresemos una de las variables

ajuste3 = stm.ols("X1~X2+X3+X4+X5+TIME",data = datos).fit()

print(ajuste3.summary())

tolerancia = 1-ajuste3.rsquared

print(tolerancia)

OLS Regression Results

==============================================================================

Dep. Variable: X1 R-squared: 0.992

Model: OLS Adj. R-squared: 0.988

Method: Least Squares F-statistic: 232.5

Date: Wed, 16 Apr 2025 Prob (F-statistic): 3.13e-09

Time: 04:05:11 Log-Likelihood: -53.843

No. Observations: 15 AIC: 119.7

Df Residuals: 9 BIC: 123.9

Df Model: 5

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 1529.0038 728.794 2.098 0.065 -119.644 3177.651

X2 0.0025 0.001 2.690 0.025 0.000 0.005

X3 0.0306 0.015 2.019 0.074 -0.004 0.065

X4 0.0101 0.008 1.337 0.214 -0.007 0.027

X5 -0.0126 0.008 -1.598 0.145 -0.031 0.005

TIME -16.2146 17.665 -0.918 0.383 -56.175 23.745

==============================================================================

Omnibus: 0.230 Durbin-Watson: 1.897

Prob(Omnibus): 0.891 Jarque-Bera (JB): 0.104

Skew: -0.153 Prob(JB): 0.949

Kurtosis: 2.729 Cond. No. 1.01e+08

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.01e+08. This might indicate that there are

strong multicollinearity or other numerical problems.

0.007681136875000938

/Users/victormorales/opt/anaconda3/lib/python3.9/site-packages/scipy/stats/_stats_py.py:1806: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=15

warnings.warn("kurtosistest only valid for n>=20 ... continuing "

Factor de inflación de la varianza

Si este valor es mucho mayor que 10 y se podría concluir que si hay multicolinealidad

vif = 1/tolerancia

vif

130.18906136858521

Ahora vamos a usar el paquete statsmodels.stats.outliers_influence, la función variance_inflation_factor:

from statsmodels.stats.outliers_influence import variance_inflation_factor

# Para cada covariable, se calcla VIF y se almacena en un dataframe

X = datos[['X1','X2','X3','X4','X5','TIME']]

X = sm.add_constant(X)

vif = pd.DataFrame()

vif["VIF Factor"] = [variance_inflation_factor(X.values, i) for i in range(X.shape[1])]

vif["Features"] = X.columns

vif.round(1)

| VIF Factor | Features | |

|---|---|---|

| 0 | 92681.7 | const |

| 1 | 130.2 | X1 |

| 2 | 1490.7 | X2 |

| 3 | 32.2 | X3 |

| 4 | 3.9 | X4 |

| 5 | 347.6 | X5 |

| 6 | 746.5 | TIME |

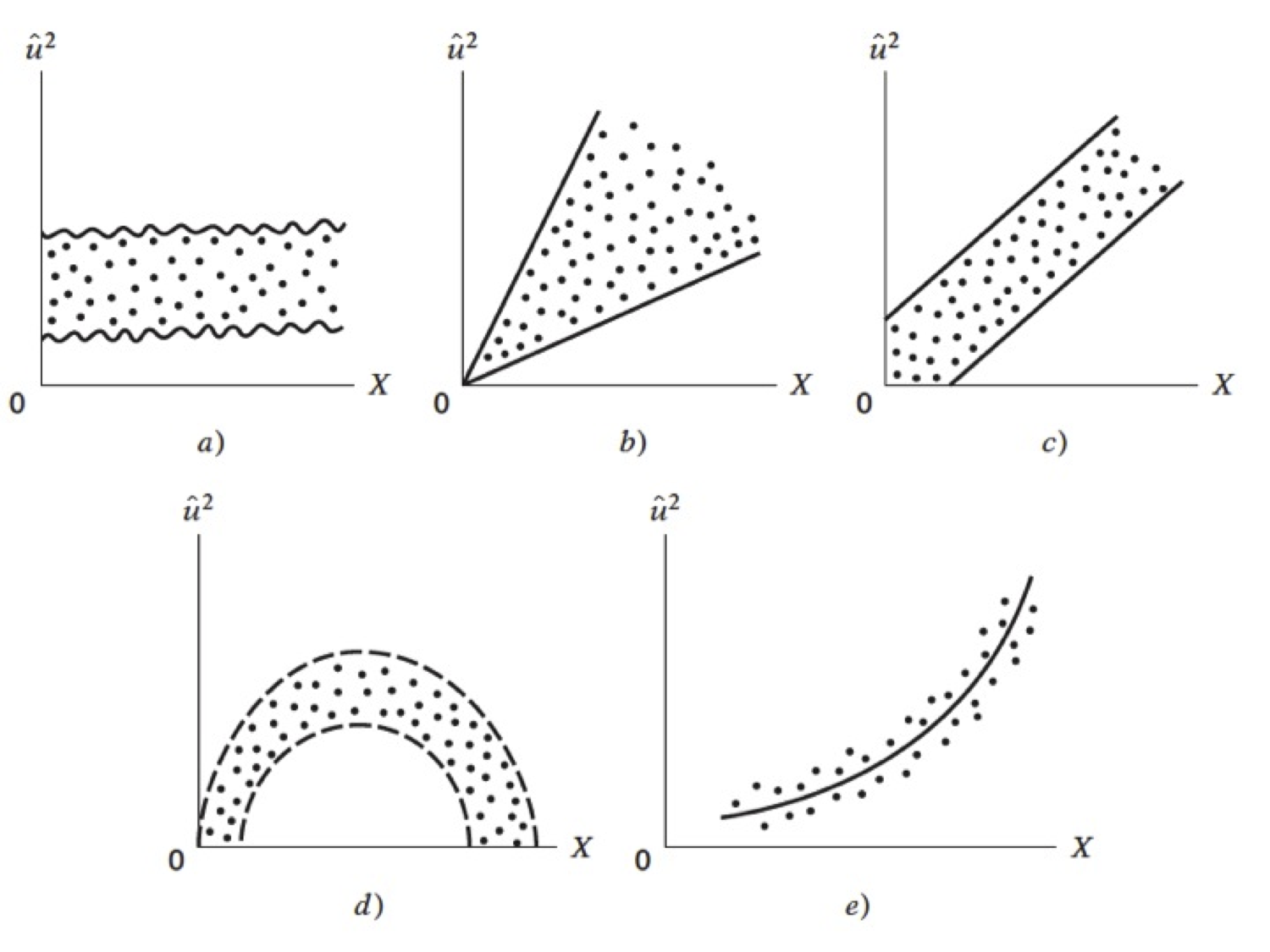

Raux = (vif[["VIF Factor"]]-1)/vif[["VIF Factor"]]