11. Árboles de decisión#

Librerías:

import pandas as pd

import numpy as np

from sklearn.tree import DecisionTreeClassifier

from sklearn.metrics import classification_report, confusion_matrix

from sklearn.tree import plot_tree

import matplotlib.pyplot as plt

from sklearn.preprocessing import OneHotEncoder

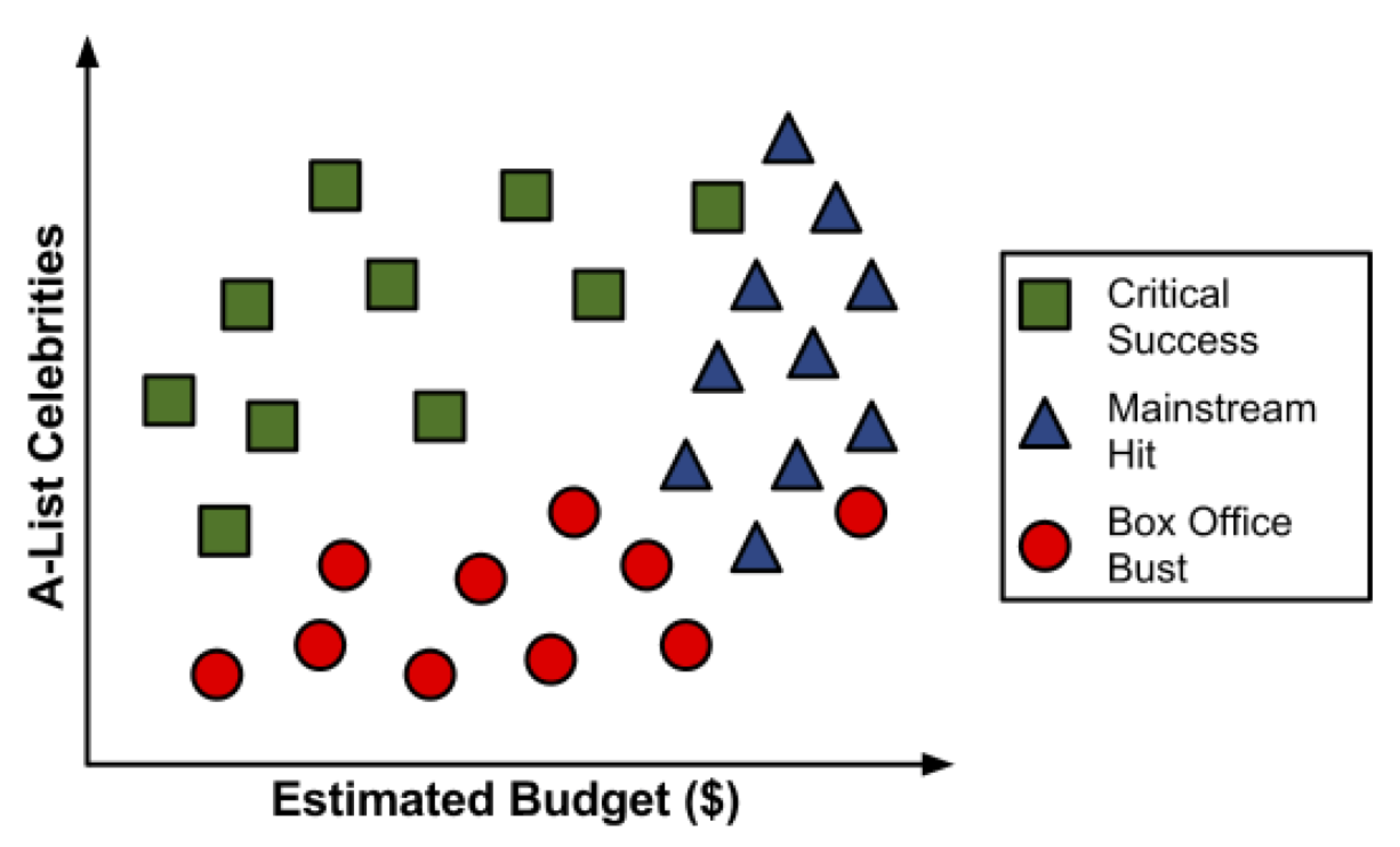

Para ilustrar el proceso de construcción del árbol, consideremos un ejemplo simple. Imagine que está trabajando para un estudio de cine de Hollywood, y su escritorio está repleto de guiones. En lugar de leer cada uno de principio a fin, usted decide desarrollar un algoritmo de árbol de decisión para predecir si una película potencial podría clasificarse en una de tres categorías:

impacto mainstream,

amado por la crítica (critic’s choice) o

fracaso de taquilla (box office bust).

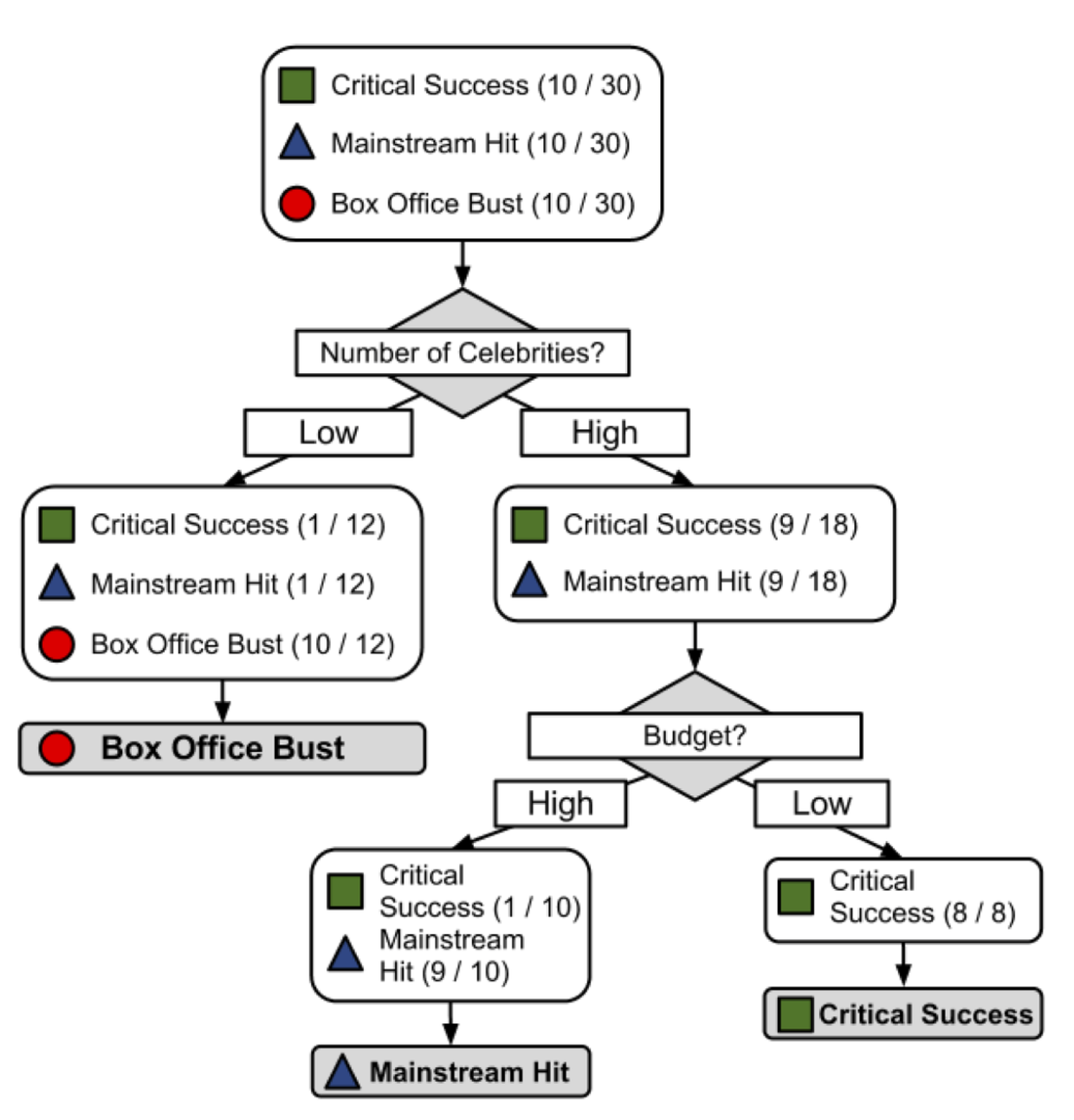

Después de revisar los datos de 30 guiones de películas diferentes, surge un patrón. Parece haber una relación entre el presupuesto de rodaje propuesto por la película, el número de celebridades A para los papeles protagónicos y las categorías de éxito.

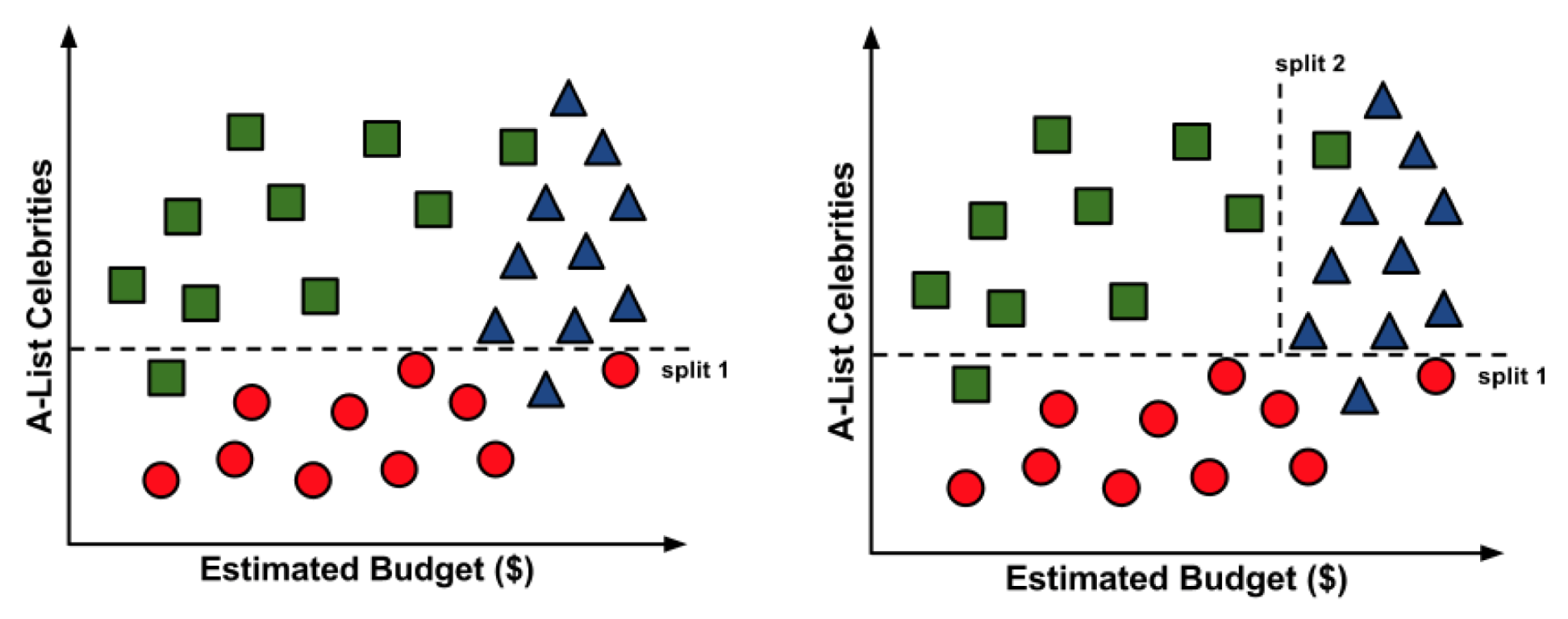

Para construir un árbol de decisión simple usando esta información, podemos aplicar una estrategia de dividir y vencer.

Resultado:

Es posible que hayas notado que las líneas diagonales podrían haber dividido los datos aún más limpiamente. Esta es una limitación de del árbol de decisiones, que utiliza divisiones paralelas a los ejes. El hecho de que cada división considere una característica a la vez evita que el árbol de decisiones forme decisiones más complejas, como “si el número de celebridades es mayor que el presupuesto estimado, entonces será un éxito crítico”.

Entonces, ¿qué es un árbol de decisión?

El modelo en sí mismo comprende una serie de decisiones lógicas, similares a un diagrama de flujo, con nodos de decisión que indican una decisión sobre un atributo. Estos se dividen en ramas que indican las elecciones de la decisión. El árbol termina con nodos de hoja o leaf nodes (también conocidos como nodos terminales) que denotan el resultado de seguir una combinación de decisiones.

Fortalezas |

Debilidades |

|---|---|

Un clasificador multiuso que funciona bien en la mayoría de los problemas |

Los modelos de árbol de decisión a menudo están sesgados hacia divisiones en características que tienen una gran cantidad de niveles |

El proceso de aprendizaje altamente automático puede manejar características numéricas o nominales, datos faltantes |

Es fácil sobreajustar o ajustar el modelo |

Utiliza solo las características más importantes |

Puede tener problemas para modelar algunas relaciones debido a la dependencia de divisiones paralelas al eje |

Se puede usar en datos con relativamente pocos ejemplos de entrenamiento o un número muy grande |

Pequeños cambios en los datos de entrenamiento pueden generar grandes cambios en la lógica de decisión |

Resultados en un modelo que puede interpretarse sin un fondo matemático (para árboles relativamente pequeños) |

Los árboles grandes pueden ser difíciles de interpretar y las decisiones que toman pueden parecer contradictorias |

Más eficiente que otros modelos complejos |

11.1. Elegir la mejor partición#

Entropía

La entropía de una muestra de datos indica qué tan mezclados están los valores de clase; el valor mínimo de 0 indica que la muestra es completamente homogénea, mientras que 1 indica la cantidad máxima de desorden.

En la fórmula de entropía, para un segmento dado de datos \((S)\), el término \(c\) se refiere al número de diferentes niveles de clase, y \(p_i\) se refiere a la proporción de valores que caen en el nivel de clase \(i\). Por ejemplo, supongamos que tenemos una partición de datos con dos clases: rojo (\(60\) por ciento) y blanco (\(40\) por ciento). Podemos calcular la entropía como:

import math

# Valores

p1 = 0.60

p2 = 0.40

# Calculo

result = -p1 * math.log2(p1) - p2 * math.log2(p2)

# Resultado

print(result)

0.9709505944546686

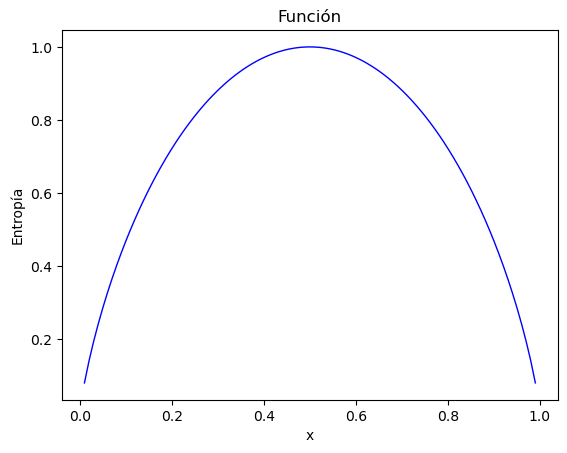

Podemos examinar la entropía para todos los posibles arreglos de dos clases. Si sabemos que la proporción de ejemplos en una clase es \(x\), entonces la proporción en la otra clase es \(1 - x\).

Creamos la función entropy y creamos valores para x de modo que se pueda visualizar la función:

import numpy as np

import matplotlib.pyplot as plt

# Definimos la funcion entropia

def entropy(x):

return -x * np.log2(x) - (1 - x) * np.log2(1 - x)

# Generar valores x de 0 a 1

x_values = np.linspace(0.01, 0.99, 100)

# Calculamos la entropia para cada x

y_values = entropy(x_values)

# Plot

plt.plot(x_values, y_values, color='blue', linewidth=1)

plt.xlabel('x')

plt.ylabel('Entropía')

plt.title('Función')

plt.show()

Como se ilustra por el pico en entropía en \(x = 0.50\), una división \(50-50\) da como resultado la entropía máxima. A medida que una clase domina cada vez más a la otra, la entropía se reduce a cero.

Dada esta medida de pureza (como la entropía), el algoritmo aún debe decidir qué característica dividir. Para esto, el algoritmo usa la entropía para calcular el cambio en la homogeneidad resultante de una división en cada característica posible. El cálculo se conoce como ganancia de información. La ganancia de información para una característica \(F\) se calcula como la diferencia entre la entropía en el segmento antes de la división \((S_1)\) y las particiones resultantes de la división \((S_2)\)

Cuanto mayor sea la ganancia de información, mejor será una función para crear grupos homogéneos después de una división en esa función.

La ganancia de información no es el único criterio de división que se puede usar para construir árboles de decisión. Otros criterios comúnmente utilizados son el índice de Gini, la relación de ganancia, entre otros. Para profundizar en estos criterios revisa: link

11.2. Ejemplo: Identificando el riesgo de un préstamo#

11.2.1. Paso 1: recopilación de datos#

Los datos representan los préstamos obtenidos de una agencia de crédito en Alemania.

# Cargar los datos

url = "https://github.com/vmoprojs/DataLectures/raw/master/credit.csv"

credit = pd.read_csv(url)

El conjunto de datos crediticios incluye \(1000\) ejemplos de préstamos, más una combinación de características numéricas y nominales que indican las características del préstamo y del solicitante del préstamo.

Una variable indica si el préstamo entró en default. Veamos si podemos determinar un patrón que prediga este resultado.

11.2.2. Paso 2: Explorar y preparar los datos#

Veamos algunos de los resultados de table() para un par de características de préstamos que parecen predecir un incumplimiento. Las características checking_balance y savings_balance indican el saldo de la cuenta de cheques y de ahorros del solicitante, y se registran como variables categóricas:

# Ver estructura de los datos

print(credit.info())

# Tablas de frecuencia para balance de cuenta corriente y de ahorros

print(credit['checking_balance'].value_counts())

print(credit['savings_balance'].value_counts())

<class 'pandas.core.frame.DataFrame'>

RangeIndex: 1000 entries, 0 to 999

Data columns (total 17 columns):

# Column Non-Null Count Dtype

--- ------ -------------- -----

0 checking_balance 1000 non-null object

1 months_loan_duration 1000 non-null int64

2 credit_history 1000 non-null object

3 purpose 1000 non-null object

4 amount 1000 non-null int64

5 savings_balance 1000 non-null object

6 employment_duration 1000 non-null object

7 percent_of_income 1000 non-null int64

8 years_at_residence 1000 non-null int64

9 age 1000 non-null int64

10 other_credit 1000 non-null object

11 housing 1000 non-null object

12 existing_loans_count 1000 non-null int64

13 job 1000 non-null object

14 dependents 1000 non-null int64

15 phone 1000 non-null object

16 default 1000 non-null object

dtypes: int64(7), object(10)

memory usage: 132.9+ KB

None

checking_balance

unknown 394

< 0 DM 274

1 - 200 DM 269

> 200 DM 63

Name: count, dtype: int64

savings_balance

< 100 DM 603

unknown 183

100 - 500 DM 103

500 - 1000 DM 63

> 1000 DM 48

Name: count, dtype: int64

Dado que los datos del préstamo se obtuvieron de Alemania, la moneda se registra en Deutsche Marks (DM). Parece una suposición válida que los saldos de cuentas corrientes y de ahorro más grandes deberían estar relacionados con una menor posibilidad de impago del préstamo.

Algunas de las funciones del préstamo son numéricas, como su plazo (months_loan_duration) y el monto de crédito solicitado (amount).

# Resumen de la duración del préstamo

print(credit['months_loan_duration'].describe())

count 1000.000000

mean 20.903000

std 12.058814

min 4.000000

25% 12.000000

50% 18.000000

75% 24.000000

max 72.000000

Name: months_loan_duration, dtype: float64

Los montos de los préstamos oscilaron entre 250 DM y 18420 DM a plazos de 4 a 72 meses, con una duración media de 18 meses y un monto de 2320 DM.

La variable default indica si el solicitante del préstamo no pudo cumplir con los términos de pago acordados y entró en incumplimiento. Un total del 30 por ciento de los préstamos entraron en mora:

# Tabla de frecuencia para el valor predicho (default)

print(credit['default'].value_counts())

default

no 700

yes 300

Name: count, dtype: int64

Una alta tasa de incumplimiento no es deseable para un banco porque significa que es poco probable que el banco recupere completamente su inversión. Si tenemos éxito, nuestro modelo identificará a los solicitantes que es probable que presenten un incumplimiento, tal que este número se pueda reducir.

Creamos el conjunto de entrenamiento y de prueba

ordenar al azar su data de crédito antes de dividir.

# Barajar las filas de forma aleatoria

np.random.seed(12345)

credit_rand = credit.sample(frac=1).reset_index(drop=True)

Confirmamos que los datos no han cambiado

# Resumen del monto del préstamo

print(credit['amount'].describe())

count 1000.000000

mean 3271.258000

std 2822.736876

min 250.000000

25% 1365.500000

50% 2319.500000

75% 3972.250000

max 18424.000000

Name: amount, dtype: float64

Ahora, podemos dividir los datos en entrenamiento (90 por ciento o 900 registros) y datos de prueba (10 por ciento o 100 registros)

# Dividir en conjunto de entrenamiento y prueba

credit_train = credit_rand.iloc[:900, :]

credit_test = credit_rand.iloc[900:, :]

Si todo salió bien, deberíamos tener alrededor del 30 por ciento de los préstamos impagos en cada uno de los conjuntos de datos.

# Proporciones de la variable 'default' en entrenamiento y prueba

print(credit_train['default'].value_counts(normalize=True))

print(credit_test['default'].value_counts(normalize=True))

default

no 0.707778

yes 0.292222

Name: proportion, dtype: float64

default

no 0.63

yes 0.37

Name: proportion, dtype: float64

11.2.3. Paso 3: entrenar un modelo en los datos#

La columna 17 en credit_train es la variable default, por lo que debemos excluirla del DataFrame de entrenamiento como una variable independiente, pero considerarla como dependiente para la clasificación.

Debemos separar los datos y seleccionar las variables con las que vamos a trabajar

# Seleccionar las características y el objetivo

features = ['checking_balance', 'months_loan_duration', 'credit_history', 'purpose', 'amount', 'savings_balance',

'employment_duration', 'percent_of_income', 'years_at_residence', 'age', 'other_credit', 'housing',

'existing_loans_count', 'job', 'dependents', 'phone']

X_train = credit_train[features]

y_train = credit_train['default']

X_test = credit_test[features]

y_test = credit_test['default']

# Codificar las variables categóricas

from sklearn.preprocessing import StandardScaler

from sklearn.compose import ColumnTransformer

from sklearn.pipeline import Pipeline

from sklearn.impute import SimpleImputer

#Definir las listas de categóricas y numéricas

numeric_features = ['months_loan_duration', 'amount','age']

categorical_features = ['checking_balance', 'credit_history', 'purpose','savings_balance',

'employment_duration', 'percent_of_income', 'years_at_residence', 'other_credit', 'housing',

'existing_loans_count', 'job', 'dependents', 'phone']

#Standscaler a caracteristicas numericas y Onehotencoder a las categoricas

preprocessor = ColumnTransformer(

transformers=[

('num', StandardScaler(), numeric_features),

('cat', Pipeline(steps=[

('imputer', SimpleImputer(strategy='most_frequent')), # Handle missing or unknown categorical values

('onehot', OneHotEncoder(handle_unknown='ignore')) # OneHotEncode the categorical features

]), categorical_features)

])

#Crear un pipeline con preprocesador y modelo

model = Pipeline(steps=[('preprocessor', preprocessor),

('classifier', DecisionTreeClassifier(

random_state=12345,

criterion='entropy',

max_depth=3))])

Entrenamos el modelo:

# Entrenar el modelo de árbol de decisión

model.fit(X_train, y_train)

Pipeline(steps=[('preprocessor',

ColumnTransformer(transformers=[('num', StandardScaler(),

['months_loan_duration',

'amount', 'age']),

('cat',

Pipeline(steps=[('imputer',

SimpleImputer(strategy='most_frequent')),

('onehot',

OneHotEncoder(handle_unknown='ignore'))]),

['checking_balance',

'credit_history', 'purpose',

'savings_balance',

'employment_duration',

'percent_of_income',

'years_at_residence',

'other_credit', 'housing',

'existing_loans_count',

'job', 'dependents',

'phone'])])),

('classifier',

DecisionTreeClassifier(criterion='entropy', max_depth=3,

random_state=12345))])In a Jupyter environment, please rerun this cell to show the HTML representation or trust the notebook. On GitHub, the HTML representation is unable to render, please try loading this page with nbviewer.org.

Pipeline(steps=[('preprocessor',

ColumnTransformer(transformers=[('num', StandardScaler(),

['months_loan_duration',

'amount', 'age']),

('cat',

Pipeline(steps=[('imputer',

SimpleImputer(strategy='most_frequent')),

('onehot',

OneHotEncoder(handle_unknown='ignore'))]),

['checking_balance',

'credit_history', 'purpose',

'savings_balance',

'employment_duration',

'percent_of_income',

'years_at_residence',

'other_credit', 'housing',

'existing_loans_count',

'job', 'dependents',

'phone'])])),

('classifier',

DecisionTreeClassifier(criterion='entropy', max_depth=3,

random_state=12345))])ColumnTransformer(transformers=[('num', StandardScaler(),

['months_loan_duration', 'amount', 'age']),

('cat',

Pipeline(steps=[('imputer',

SimpleImputer(strategy='most_frequent')),

('onehot',

OneHotEncoder(handle_unknown='ignore'))]),

['checking_balance', 'credit_history',

'purpose', 'savings_balance',

'employment_duration', 'percent_of_income',

'years_at_residence', 'other_credit',

'housing', 'existing_loans_count', 'job',

'dependents', 'phone'])])['months_loan_duration', 'amount', 'age']

StandardScaler()

['checking_balance', 'credit_history', 'purpose', 'savings_balance', 'employment_duration', 'percent_of_income', 'years_at_residence', 'other_credit', 'housing', 'existing_loans_count', 'job', 'dependents', 'phone']

SimpleImputer(strategy='most_frequent')

OneHotEncoder(handle_unknown='ignore')

DecisionTreeClassifier(criterion='entropy', max_depth=3, random_state=12345)

# Extraer el modelo de árbol de decisión ajustado

decision_tree = model.named_steps['classifier']

# Asegurarte de que el modelo es el DecisionTreeClassifier

print(type(decision_tree))

# Obtener los nombres de las características como una lista

feature_names = preprocessor.get_feature_names_out().tolist()

from sklearn.tree import export_text

# Imprimir el árbol de decisión como texto

tree_text = export_text(decision_tree, feature_names=feature_names)

print(tree_text)

<class 'sklearn.tree._classes.DecisionTreeClassifier'>

|--- cat__checking_balance_unknown <= 0.50

| |--- num__months_loan_duration <= 0.15

| | |--- cat__credit_history_very good <= 0.50

| | | |--- class: no

| | |--- cat__credit_history_very good > 0.50

| | | |--- class: yes

| |--- num__months_loan_duration > 0.15

| | |--- cat__savings_balance_< 100 DM <= 0.50

| | | |--- class: no

| | |--- cat__savings_balance_< 100 DM > 0.50

| | | |--- class: yes

|--- cat__checking_balance_unknown > 0.50

| |--- cat__other_credit_none <= 0.50

| | |--- cat__purpose_furniture/appliances <= 0.50

| | | |--- class: yes

| | |--- cat__purpose_furniture/appliances > 0.50

| | | |--- class: no

| |--- cat__other_credit_none > 0.50

| | |--- cat__credit_history_critical <= 0.50

| | | |--- class: no

| | |--- cat__credit_history_critical > 0.50

| | | |--- class: no

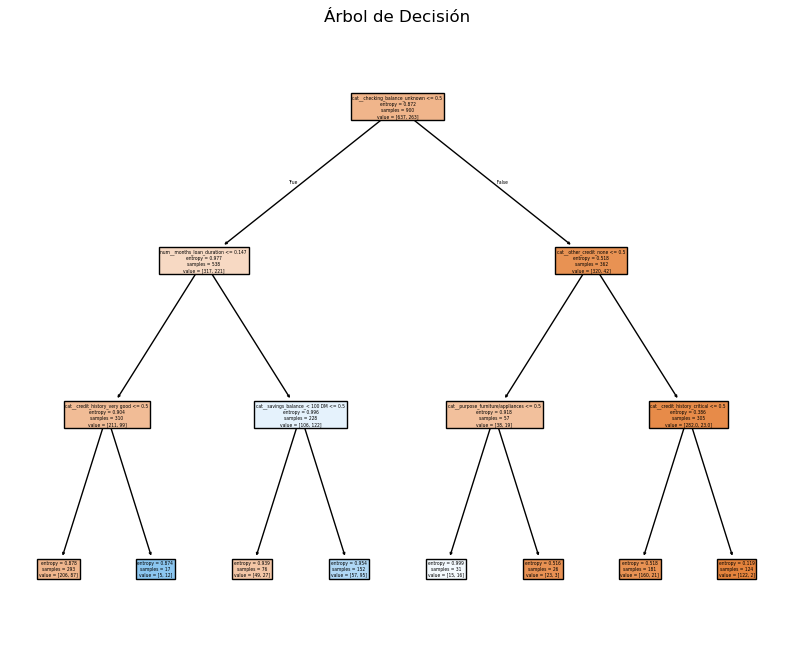

# Graficar el árbol de decisión

plt.figure(figsize=(10, 8))

plot_tree(decision_tree, filled=True, feature_names=feature_names)

plt.title("Árbol de Decisión")

plt.show()

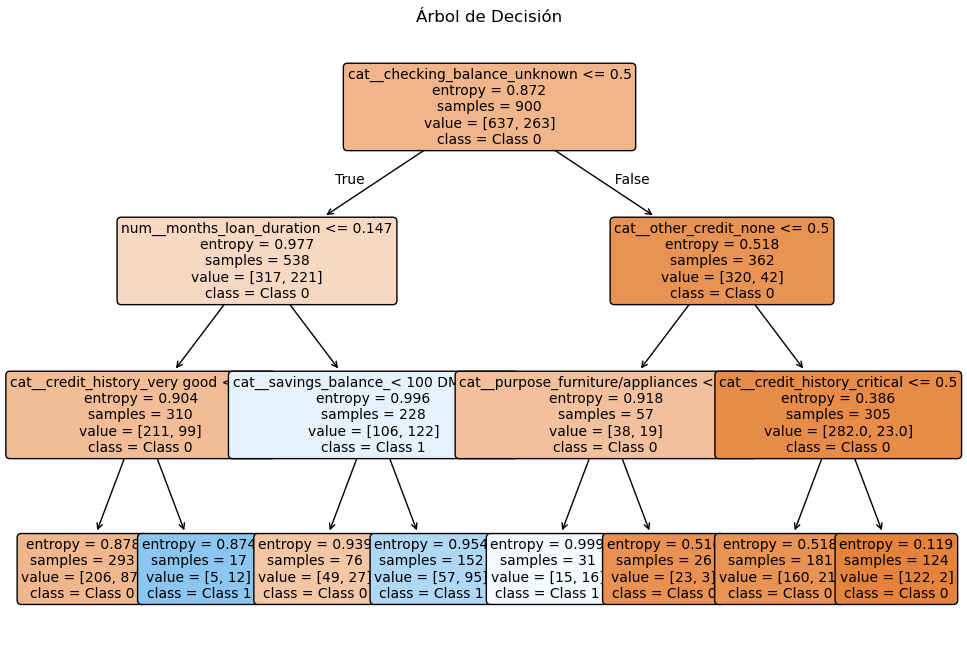

from sklearn import tree

# Función para graficar el árbol

def plot_decision_tree(model):

plt.figure(figsize=(12, 8))

tree.plot_tree(model, filled=True, rounded=True,

feature_names=feature_names,

class_names=['Class 0', 'Class 1'],

fontsize=10)

plt.title("Árbol de Decisión")

plt.show()

# Llamar a la función para graficar

plot_decision_tree(decision_tree)

11.2.4. Paso 4: evaluar el rendimiento del modelo#

# Predecir con el conjunto de prueba

credit_pred = model.predict(X_test)

credit_pred_prob = model.predict_proba(X_test)[:, 1]

# Matriz de confusión y reportes de clasificación

conf_matrix = confusion_matrix(y_test, credit_pred)

class_report = classification_report(y_test, credit_pred)

print(conf_matrix)

print(class_report)

[[51 12]

[26 11]]

precision recall f1-score support

no 0.66 0.81 0.73 63

yes 0.48 0.30 0.37 37

accuracy 0.62 100

macro avg 0.57 0.55 0.55 100

weighted avg 0.59 0.62 0.59 100

# Proporciones de la matriz de confusión

conf_matrix_norm1 = conf_matrix.astype('float') / conf_matrix.sum(axis=1)[:, np.newaxis]

conf_matrix_norm2 = conf_matrix.astype('float') / conf_matrix.sum(axis=0)[np.newaxis, :]

print(conf_matrix_norm1)

print(conf_matrix_norm2)

[[0.80952381 0.19047619]

[0.7027027 0.2972973 ]]

[[0.66233766 0.52173913]

[0.33766234 0.47826087]]

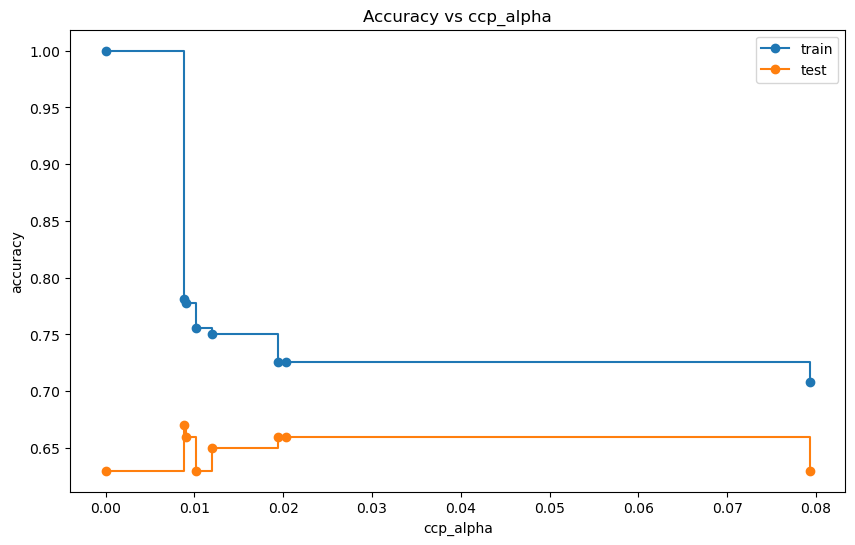

11.3. Mejorando la estimación#

La definición de la medida de complejidad-costo (cost-complexity measure):

Para cualquier subárbol \(T < T_{max}\), definiremos su complejidad como \(|\tilde{T}|\), el número de nodos terminales u hoja en \(T\) . Sea \(\alpha ≥ 0\) un número real llamado parámetro de complejidad y defina la medida de costo-complejidad \(R_{\alpha}(T)\) como:

Cuantos más nodos de hoja (nodos sin hijos) contenga el árbol, mayor será su complejidad porque tenemos más flexibilidad para dividir el espacio en partes más pequeñas y, por lo tanto, más posibilidades para ajustar los datos de entrenamiento. También está la cuestión de cuánta importancia darle al tamaño del árbol. El parámetro de complejidad \(\alpha\) ajusta eso.

Al final, la medida de la complejidad-costo surge como una versión penalizada de la tasa de error de resustitución. Esta es la función a minimizar al podar el árbol.

Qué árbol seleccionar a final depende de \(\alpha\). Si \(\alpha=0\) entonces el árbol más grande será elegido porque el término de complejidad se anula. Si \(\alpha \to \infty\), se elige un solo nodo.

# Obtener los valores de ccp_alpha para la poda

X_train_transformed = model.named_steps['preprocessor'].transform(X_train)

path = decision_tree.cost_complexity_pruning_path(X_train_transformed, y_train)

ccp_alphas, impurities = path.ccp_alphas, path.impurities

# Entrenar árboles de decisión con diferentes valores de ccp_alpha

clfs = []

for ccp_alpha in ccp_alphas:

# clf = DecisionTreeClassifier(random_state=12345, ccp_alpha=ccp_alpha,class_weight="balanced")

clf = DecisionTreeClassifier(random_state=12345, ccp_alpha=ccp_alpha,criterion='entropy')

clf.fit(X_train_transformed, y_train)

clfs.append(clf)

# Seleccionar el mejor árbol basado en la precisión de validación cruzada

X_test_transformed = model.named_steps['preprocessor'].transform(X_test)

train_scores = [clf.score(X_train_transformed, y_train) for clf in clfs]

test_scores = [clf.score(X_test_transformed, y_test) for clf in clfs]

# Graficar la precisión del entrenamiento y la prueba en función de ccp_alpha

plt.figure(figsize=(10, 6))

plt.plot(ccp_alphas, train_scores, marker='o', label='train', drawstyle="steps-post")

plt.plot(ccp_alphas, test_scores, marker='o', label='test', drawstyle="steps-post")

plt.xlabel("ccp_alpha")

plt.ylabel("accuracy")

plt.legend()

plt.title("Accuracy vs ccp_alpha")

plt.show()

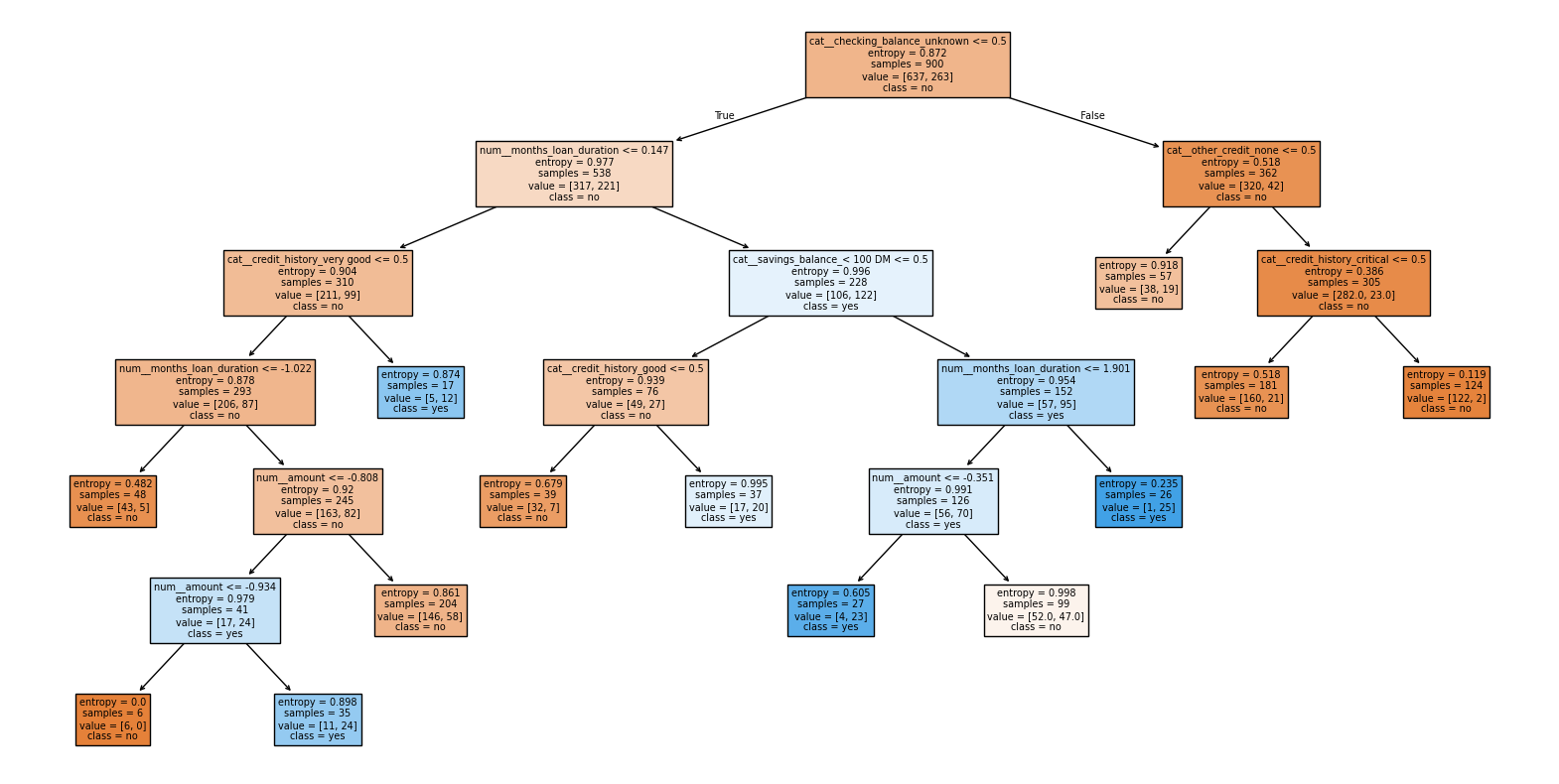

# Seleccionar el mejor modelo basado en el rendimiento de la prueba

best_index = np.argmax(test_scores)

best_ccp_alpha = ccp_alphas[best_index]

best_model = clfs[best_index]

# Imprimir el mejor modelo (el árbol de decisión podado)

plt.figure(figsize=(20,10))

plot_tree(best_model, feature_names=feature_names, class_names=['no', 'yes'], filled=True)

plt.show()

# Predecir con el conjunto de prueba usando el mejor modelo

credit_pred = best_model.predict(X_test_transformed)

# Matriz de confusión y reportes de clasificación

conf_matrix = confusion_matrix(y_test, credit_pred)

class_report = classification_report(y_test, credit_pred)

print(conf_matrix)

print(class_report)

[[55 8]

[25 12]]

precision recall f1-score support

no 0.69 0.87 0.77 63

yes 0.60 0.32 0.42 37

accuracy 0.67 100

macro avg 0.64 0.60 0.60 100

weighted avg 0.66 0.67 0.64 100

# Proporciones de la matriz de confusión

conf_matrix_norm1 = conf_matrix.astype('float') / conf_matrix.sum(axis=1)[:, np.newaxis]

conf_matrix_norm2 = conf_matrix.astype('float') / conf_matrix.sum(axis=0)[np.newaxis, :]

print(conf_matrix_norm1)

print(conf_matrix_norm2)

[[0.87301587 0.12698413]

[0.67567568 0.32432432]]

[[0.6875 0.4 ]

[0.3125 0.6 ]]