8. Regresión lineal#

Abordemos las primeras ideas de regresión lineal a través de un ejemplo práctico:

Creamos dos variables, Ingreso y Consumo Esperado

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import random

import statsmodels.formula.api as smf

from statsmodels.graphics.regressionplots import abline_plot

df = pd.DataFrame({

'Col1': [1,2,3],

'Col2': [4,5,6]

})

familia = pd.DataFrame({'Y':[55,60,65,70,75,

65,70,74,80,85,88,

79,84,90,94,98,

80,93,95,103,108,113,115,

102,107,110,116,118,125,

110,115,120,130,135,140,

120,136,140,144,145,

135,137,140,152,157,160,162,

137,145,155,165,175,189,

150,152,175,178,180,185,191

],'X':[80,80,80,80,80,

100,100,100,100,100,100,

120,120,120,120,120,

140,140,140,140,140,140,140,

160,160,160,160,160,160,

180,180,180,180,180,180,

200,200,200,200,200,

220,220,220,220,220,220,220,

240,240,240,240,240,240,

260,260,260,260,260,260,260

]})

familia.head()

| Y | X | |

|---|---|---|

| 0 | 55 | 80 |

| 1 | 60 | 80 |

| 2 | 65 | 80 |

| 3 | 70 | 80 |

| 4 | 75 | 80 |

ingresos = np.arange(80,261,20)

ingresos

consumoEsperado = [65,77,89,101,113,125,137,149,161,173]

consumoEsperado

familia.columns

Index(['Y', 'X'], dtype='object')

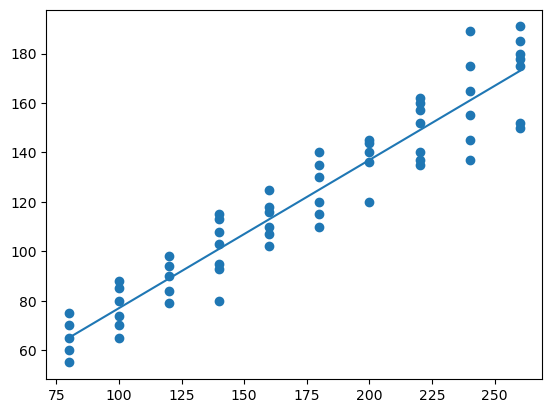

plt.figure() # llama al dispositivo grafico

plt.plot(ingresos,consumoEsperado)

plt.scatter(familia['X'],familia['Y'])

plt.show()

¿Qué hemos hecho?

¿Qué significa que sea lineal?

El término regresión lineal siempre significará una regresión lineal en los parámetros; los \(\beta\) (es decir, los parámetros) se elevan sólo a la primera potencia. Puede o no ser lineal en las variables explicativas \(X\).

Para evidenciar la factibilidad del uso de RL en este caso, vamos a obtener una muestra de la población:

nS = familia.shape

type(nS)

indice = np.arange(0,nS[0])

indice # Creamos una variable indicadora para obtener una muestra

array([ 0, 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16,

17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 27, 28, 29, 30, 31, 32, 33,

34, 35, 36, 37, 38, 39, 40, 41, 42, 43, 44, 45, 46, 47, 48, 49, 50,

51, 52, 53, 54, 55, 56, 57, 58, 59])

random.seed(8519)

muestra = random.sample(list(indice),k = 20) # cambio de array a lista

muestra # samos sample para obtener una muestra sin reemplazo del tamaño indicado

[54, 59, 33, 25, 32, 39, 47, 51, 18, 3, 34, 12, 29, 7, 26, 5, 56, 50, 44, 13]

ingreso_muestra = familia.loc[muestra,'X']

consumo_muestra = familia.loc[muestra,'Y']

df = pd.DataFrame(list(zip(consumo_muestra,ingreso_muestra)),columns = ['consumo_muestra','ingreso_muestra'])

ajuste_1 = smf.ols('consumo_muestra~ingreso_muestra',data =df).fit()

print(ajuste_1.summary())

OLS Regression Results

==============================================================================

Dep. Variable: consumo_muestra R-squared: 0.909

Model: OLS Adj. R-squared: 0.904

Method: Least Squares F-statistic: 179.4

Date: Thu, 22 May 2025 Prob (F-statistic): 8.44e-11

Time: 06:11:31 Log-Likelihood: -76.677

No. Observations: 20 AIC: 157.4

Df Residuals: 18 BIC: 159.3

Df Model: 1

Covariance Type: nonrobust

===================================================================================

coef std err t P>|t| [0.025 0.975]

-----------------------------------------------------------------------------------

Intercept 13.2650 8.817 1.504 0.150 -5.259 31.789

ingreso_muestra 0.6226 0.046 13.394 0.000 0.525 0.720

==============================================================================

Omnibus: 3.437 Durbin-Watson: 2.369

Prob(Omnibus): 0.179 Jarque-Bera (JB): 2.288

Skew: -0.828 Prob(JB): 0.319

Kurtosis: 2.997 Cond. No. 634.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

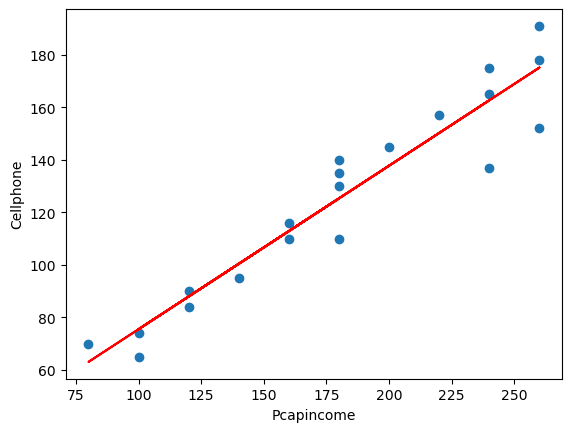

plt.figure()

plt.plot(df.ingreso_muestra,df.consumo_muestra,'o')

plt.plot(df.ingreso_muestra,ajuste_1.fittedvalues,'-',color='r')

plt.xlabel('Pcapincome')

plt.ylabel('Cellphone')

Text(0, 0.5, 'Cellphone')

8.1. Regresión: Paso a paso#

La función poblacional sería:

Como no es observable, se usa la muestral

Es por esto que los residuos se obtienen a través de los betas:

Diferenciando se obtiene:

donde

Abrimos la tabla3.2, vamos a obtener:

salario promedio por hora (Y) y

los años de escolaridad (X).

consumo = pd.read_csv('https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Tabla3_2.csv',

sep = ';',decimal = '.')

consumo.head()

| Y | X | |

|---|---|---|

| 0 | 70 | 80 |

| 1 | 65 | 100 |

| 2 | 90 | 120 |

| 3 | 95 | 140 |

| 4 | 110 | 160 |

media_x = np.mean(consumo['X'])

media_y = np.mean(consumo['Y'])

n = consumo.shape[0]

sumcuad_x = np.sum(consumo['X']*consumo['X'])

sum_xy = np.sum(consumo['X']*consumo['Y'])

beta_som = (sum_xy-n*media_x*media_y)/(sumcuad_x-n*(media_x**2))

alpha_som = media_y-beta_som*media_x

(alpha_som,beta_som)

(24.454545454545467, 0.509090909090909)

Verificamos lo anterior mediante:

reg_1 = smf.ols('Y~X',data = consumo)

print(reg_1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: Y R-squared: 0.962

Model: OLS Adj. R-squared: 0.957

Method: Least Squares F-statistic: 202.9

Date: Thu, 22 May 2025 Prob (F-statistic): 5.75e-07

Time: 06:11:31 Log-Likelihood: -31.781

No. Observations: 10 AIC: 67.56

Df Residuals: 8 BIC: 68.17

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 24.4545 6.414 3.813 0.005 9.664 39.245

X 0.5091 0.036 14.243 0.000 0.427 0.592

==============================================================================

Omnibus: 1.060 Durbin-Watson: 2.680

Prob(Omnibus): 0.589 Jarque-Bera (JB): 0.777

Skew: -0.398 Prob(JB): 0.678

Kurtosis: 1.891 Cond. No. 561.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

/opt/anaconda3/lib/python3.12/site-packages/scipy/stats/_axis_nan_policy.py:531: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=10

res = hypotest_fun_out(*samples, **kwds)

Veamos cómo queda nuestra estimación:

y_ajustado = alpha_som+beta_som*consumo['X']

dfAux = pd.DataFrame(list(zip(consumo['X'],y_ajustado)),

columns = ['X','y_ajustado'])

dfAux

| X | y_ajustado | |

|---|---|---|

| 0 | 80 | 65.181818 |

| 1 | 100 | 75.363636 |

| 2 | 120 | 85.545455 |

| 3 | 140 | 95.727273 |

| 4 | 160 | 105.909091 |

| 5 | 180 | 116.090909 |

| 6 | 200 | 126.272727 |

| 7 | 220 | 136.454545 |

| 8 | 240 | 146.636364 |

| 9 | 260 | 156.818182 |

e = consumo['Y']-y_ajustado

dfAux = pd.DataFrame(list(zip(consumo['X'],consumo['Y'],y_ajustado,e)),

columns = ['X','Y','y_ajustado','e'])

dfAux

| X | Y | y_ajustado | e | |

|---|---|---|---|---|

| 0 | 80 | 70 | 65.181818 | 4.818182 |

| 1 | 100 | 65 | 75.363636 | -10.363636 |

| 2 | 120 | 90 | 85.545455 | 4.454545 |

| 3 | 140 | 95 | 95.727273 | -0.727273 |

| 4 | 160 | 110 | 105.909091 | 4.090909 |

| 5 | 180 | 115 | 116.090909 | -1.090909 |

| 6 | 200 | 120 | 126.272727 | -6.272727 |

| 7 | 220 | 140 | 136.454545 | 3.545455 |

| 8 | 240 | 155 | 146.636364 | 8.363636 |

| 9 | 260 | 150 | 156.818182 | -6.818182 |

np.mean(e)

np.corrcoef(e,consumo['X'])

array([[1.00000000e+00, 1.13838806e-15],

[1.13838806e-15, 1.00000000e+00]])

SCT = np.sum((consumo['Y']-media_y)**2)

SCE = np.sum((y_ajustado-media_y)**2)

SCR = np.sum(e**2)

R_2 = SCE/SCT

R_2

0.9620615604867568

print(reg_1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: Y R-squared: 0.962

Model: OLS Adj. R-squared: 0.957

Method: Least Squares F-statistic: 202.9

Date: Thu, 22 May 2025 Prob (F-statistic): 5.75e-07

Time: 06:11:31 Log-Likelihood: -31.781

No. Observations: 10 AIC: 67.56

Df Residuals: 8 BIC: 68.17

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 24.4545 6.414 3.813 0.005 9.664 39.245

X 0.5091 0.036 14.243 0.000 0.427 0.592

==============================================================================

Omnibus: 1.060 Durbin-Watson: 2.680

Prob(Omnibus): 0.589 Jarque-Bera (JB): 0.777

Skew: -0.398 Prob(JB): 0.678

Kurtosis: 1.891 Cond. No. 561.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

/opt/anaconda3/lib/python3.12/site-packages/scipy/stats/_axis_nan_policy.py:531: UserWarning: kurtosistest only valid for n>=20 ... continuing anyway, n=10

res = hypotest_fun_out(*samples, **kwds)

Otro ejemplo

uu = 'https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/table2_8.csv'

datos = pd.read_csv(uu,sep = ';')

datos.shape

datos.columns

m1 = smf.ols('FOODEXP~TOTALEXP',data = datos)

print(m1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: FOODEXP R-squared: 0.370

Model: OLS Adj. R-squared: 0.358

Method: Least Squares F-statistic: 31.10

Date: Thu, 22 May 2025 Prob (F-statistic): 8.45e-07

Time: 06:11:32 Log-Likelihood: -308.16

No. Observations: 55 AIC: 620.3

Df Residuals: 53 BIC: 624.3

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 94.2088 50.856 1.852 0.070 -7.796 196.214

TOTALEXP 0.4368 0.078 5.577 0.000 0.280 0.594

==============================================================================

Omnibus: 0.763 Durbin-Watson: 2.083

Prob(Omnibus): 0.683 Jarque-Bera (JB): 0.258

Skew: 0.120 Prob(JB): 0.879

Kurtosis: 3.234 Cond. No. 3.66e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 3.66e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

Regresamos el gasto total en el gasto en alimentos

¿Son los coeficientes diferentes de cero?

import scipy.stats as st

t_ho = 0

t1 = (0.4368-t_ho)/ 0.078

(1-st.t.cdf(t1,df = 53))

3.8888077047438685e-07

t_ho = 0.3

t1 = (0.4368-t_ho)/ 0.078

(1-st.t.cdf(np.abs(t1),df = 53))

0.04261898819196597

Interpretación de los coeficientes

El coeficiente de la variable dependiente mide la tasa de cambio (derivada=pendiente) del modelo

La interpretación suele ser En promedio, el aumento de una unidad en la variable independiente produce un aumento/disminución de \(\beta_i\) cantidad en la variable dependiente

Interprete la regresión anterior.

8.1.1. Práctica: Paridad del poder de compra#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Tabla5_9.csv"

datos = pd.read_csv(uu,sep = ';')

datos.head()

| COUNTRY | BMACLC | BMAC$ | EXCH | PPP | LOCALC | |

|---|---|---|---|---|---|---|

| 0 | United States | 2.54 | 2.54 | -99999.00 | -99999.00 | -99999 |

| 1 | Argentina | 2.50 | 2.50 | 1.00 | 0.98 | -40 |

| 2 | Australia | 3.00 | 1.52 | 1.98 | 1.18 | -35 |

| 3 | Brazil | 3.60 | 1.64 | 2.19 | 1.42 | -31 |

| 4 | Britain | 1.99 | 2.85 | 1.43 | 1.28 | 12 |

datos['EXCH'] = datos.EXCH.replace(to_replace= -99999, value=np.nan)

datos['PPP'] = datos.PPP.replace(to_replace = -99999, value = np.nan)

datos['LOCALC'] = datos.LOCALC.replace(to_replace= -99999, value = np.nan)

datos.head()

| COUNTRY | BMACLC | BMAC$ | EXCH | PPP | LOCALC | |

|---|---|---|---|---|---|---|

| 0 | United States | 2.54 | 2.54 | NaN | NaN | NaN |

| 1 | Argentina | 2.50 | 2.50 | 1.00 | 0.98 | -40.0 |

| 2 | Australia | 3.00 | 1.52 | 1.98 | 1.18 | -35.0 |

| 3 | Brazil | 3.60 | 1.64 | 2.19 | 1.42 | -31.0 |

| 4 | Britain | 1.99 | 2.85 | 1.43 | 1.28 | 12.0 |

Regresamos la paridad del poder de compra en la tasa de cambio

reg1 = smf.ols('EXCH~PPP',data = datos)

print(reg1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: EXCH R-squared: 0.987

Model: OLS Adj. R-squared: 0.986

Method: Least Squares F-statistic: 2066.

Date: Thu, 22 May 2025 Prob (F-statistic): 8.80e-28

Time: 06:11:32 Log-Likelihood: -205.44

No. Observations: 30 AIC: 414.9

Df Residuals: 28 BIC: 417.7

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -61.3889 44.987 -1.365 0.183 -153.541 30.763

PPP 1.8153 0.040 45.450 0.000 1.733 1.897

==============================================================================

Omnibus: 35.744 Durbin-Watson: 2.062

Prob(Omnibus): 0.000 Jarque-Bera (JB): 94.065

Skew: -2.585 Prob(JB): 3.75e-21

Kurtosis: 9.966 Cond. No. 1.18e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 1.18e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

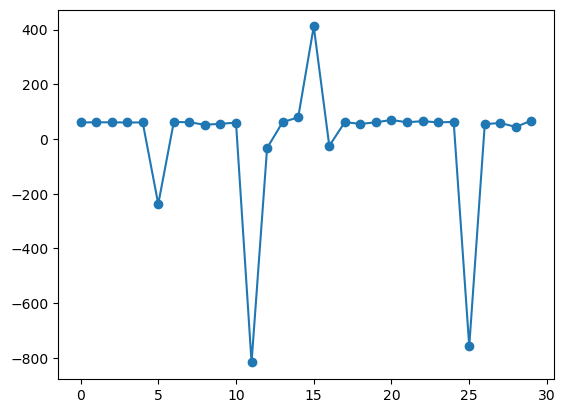

plt.figure()

plt.plot(np.arange(0,30),reg1.fit().resid,'-o')

[<matplotlib.lines.Line2D at 0x31da91280>]

reg3 = smf.ols('np.log(EXCH)~np.log(PPP)',data = datos)

print(reg3.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: np.log(EXCH) R-squared: 0.983

Model: OLS Adj. R-squared: 0.983

Method: Least Squares F-statistic: 1655.

Date: Thu, 22 May 2025 Prob (F-statistic): 1.87e-26

Time: 06:11:32 Log-Likelihood: -7.4056

No. Observations: 30 AIC: 18.81

Df Residuals: 28 BIC: 21.61

Df Model: 1

Covariance Type: nonrobust

===============================================================================

coef std err t P>|t| [0.025 0.975]

-------------------------------------------------------------------------------

Intercept 0.3436 0.086 3.990 0.000 0.167 0.520

np.log(PPP) 1.0023 0.025 40.688 0.000 0.952 1.053

==============================================================================

Omnibus: 2.829 Durbin-Watson: 1.629

Prob(Omnibus): 0.243 Jarque-Bera (JB): 1.449

Skew: -0.179 Prob(JB): 0.485

Kurtosis: 1.985 Cond. No. 5.38

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

La PPA sostiene que con una unidad de moneda debe ser posible comprar la misma canasta de bienes en todos los países.

8.1.2. Práctica: Sueño#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/sleep75.csv"

datos = pd.read_csv(uu,sep = ",",header=None)

datos.columns

datos.columns = ["age","black","case","clerical","construc","educ","earns74","gdhlth","inlf", "leis1", "leis2", "leis3", "smsa", "lhrwage", "lothinc", "male", "marr", "prot", "rlxall", "selfe", "sleep", "slpnaps", "south", "spsepay", "spwrk75", "totwrk" , "union" , "worknrm" , "workscnd", "exper" , "yngkid","yrsmarr", "hrwage", "agesq"]

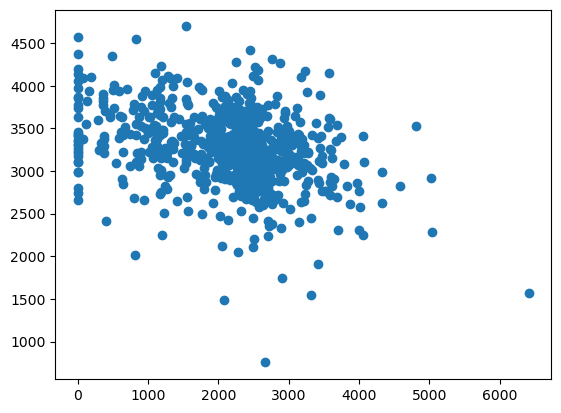

#totwrk: minutos trabajados por semana

# sleep: minutos dormidos por semana

plt.figure()

plt.scatter(datos['totwrk'],datos['sleep'])

<matplotlib.collections.PathCollection at 0x31db12270>

dormir = smf.ols('sleep~totwrk',data = datos)

print(dormir.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: sleep R-squared: 0.103

Model: OLS Adj. R-squared: 0.102

Method: Least Squares F-statistic: 81.09

Date: Thu, 22 May 2025 Prob (F-statistic): 1.99e-18

Time: 06:11:32 Log-Likelihood: -5267.1

No. Observations: 706 AIC: 1.054e+04

Df Residuals: 704 BIC: 1.055e+04

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 3586.3770 38.912 92.165 0.000 3509.979 3662.775

totwrk -0.1507 0.017 -9.005 0.000 -0.184 -0.118

==============================================================================

Omnibus: 68.651 Durbin-Watson: 1.955

Prob(Omnibus): 0.000 Jarque-Bera (JB): 192.044

Skew: -0.483 Prob(JB): 1.99e-42

Kurtosis: 5.365 Cond. No. 5.71e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 5.71e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

Para acceder a elementos de la estimación

print(dormir.fit().bse)

print(dormir.fit().params)

Intercept 38.912427

totwrk 0.016740

dtype: float64

Intercept 3586.376952

totwrk -0.150746

dtype: float64

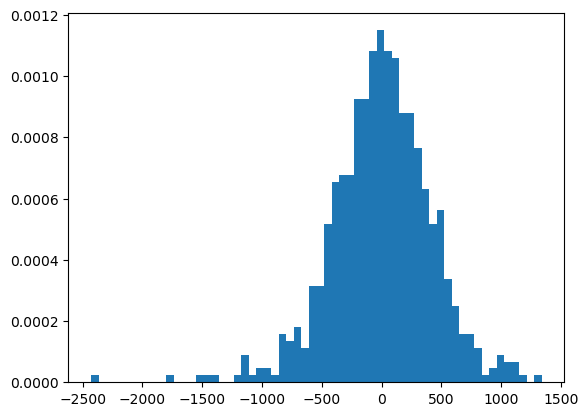

Intervalo de confianza para \(\beta_2\) y veamos los residuos

dormir.fit().params[1]+(-2*dormir.fit().bse[1],2*dormir.fit().bse[1])

/var/folders/3s/mwy450px7bz09c4zp_hpgl480000gn/T/ipykernel_6848/2900924520.py:1: FutureWarning: Series.__getitem__ treating keys as positions is deprecated. In a future version, integer keys will always be treated as labels (consistent with DataFrame behavior). To access a value by position, use `ser.iloc[pos]`

dormir.fit().params[1]+(-2*dormir.fit().bse[1],2*dormir.fit().bse[1])

array([-0.18422633, -0.11726532])

plt.figure()

plt.hist(dormir.fit().resid,bins = 60,density = True);

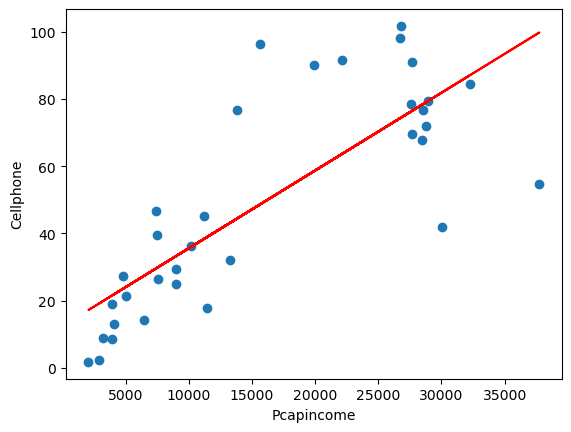

8.2. Transformaciones lineales#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Table%2031_3.csv"

datos = pd.read_csv(uu, sep =';')

reg_1 = smf.ols('Cellphone~Pcapincome',data = datos)

print(reg_1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: Cellphone R-squared: 0.626

Model: OLS Adj. R-squared: 0.615

Method: Least Squares F-statistic: 53.67

Date: Thu, 22 May 2025 Prob (F-statistic): 2.50e-08

Time: 06:11:33 Log-Likelihood: -148.94

No. Observations: 34 AIC: 301.9

Df Residuals: 32 BIC: 304.9

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 12.4795 6.109 2.043 0.049 0.037 24.922

Pcapincome 0.0023 0.000 7.326 0.000 0.002 0.003

==============================================================================

Omnibus: 1.398 Durbin-Watson: 2.381

Prob(Omnibus): 0.497 Jarque-Bera (JB): 0.531

Skew: 0.225 Prob(JB): 0.767

Kurtosis: 3.414 Cond. No. 3.46e+04

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 3.46e+04. This might indicate that there are

strong multicollinearity or other numerical problems.

plt.figure()

plt.plot(datos.Pcapincome,datos.Cellphone,'o')

plt.plot(datos.Pcapincome,reg_1.fit().fittedvalues,'-',color='r')

plt.xlabel('Pcapincome')

plt.ylabel('Cellphone')

Text(0, 0.5, 'Cellphone')

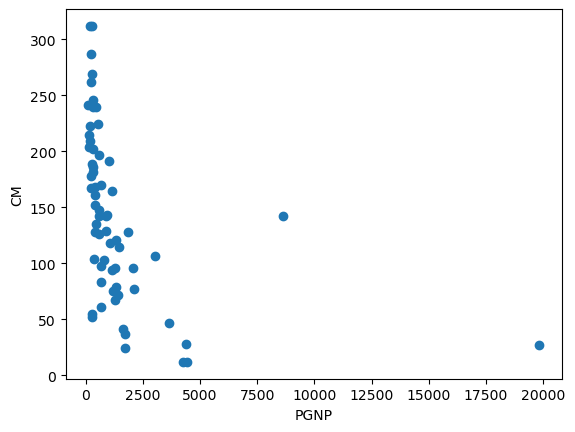

8.2.1. Modelo reciproco#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/tabla_6_4.csv"

datos = pd.read_csv(uu,sep = ';')

datos.describe()

| CM | FLR | PGNP | TFR | |

|---|---|---|---|---|

| count | 64.000000 | 64.000000 | 64.000000 | 64.000000 |

| mean | 141.500000 | 51.187500 | 1401.250000 | 5.549688 |

| std | 75.978067 | 26.007859 | 2725.695775 | 1.508993 |

| min | 12.000000 | 9.000000 | 120.000000 | 1.690000 |

| 25% | 82.000000 | 29.000000 | 300.000000 | 4.607500 |

| 50% | 138.500000 | 48.000000 | 620.000000 | 6.040000 |

| 75% | 192.500000 | 77.250000 | 1317.500000 | 6.615000 |

| max | 312.000000 | 95.000000 | 19830.000000 | 8.490000 |

plt.figure()

plt.plot(datos.PGNP,datos.CM,'o')

plt.xlabel('PGNP')

plt.ylabel('CM')

Text(0, 0.5, 'CM')

reg1 = smf.ols('CM~PGNP',data = datos)

print(reg1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: CM R-squared: 0.166

Model: OLS Adj. R-squared: 0.153

Method: Least Squares F-statistic: 12.36

Date: Thu, 22 May 2025 Prob (F-statistic): 0.000826

Time: 06:11:33 Log-Likelihood: -361.64

No. Observations: 64 AIC: 727.3

Df Residuals: 62 BIC: 731.6

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 157.4244 9.846 15.989 0.000 137.743 177.105

PGNP -0.0114 0.003 -3.516 0.001 -0.018 -0.005

==============================================================================

Omnibus: 3.321 Durbin-Watson: 1.931

Prob(Omnibus): 0.190 Jarque-Bera (JB): 2.545

Skew: 0.345 Prob(JB): 0.280

Kurtosis: 2.309 Cond. No. 3.43e+03

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

[2] The condition number is large, 3.43e+03. This might indicate that there are

strong multicollinearity or other numerical problems.

datos['RepPGNP'] = 1/datos.PGNP

reg2 = smf.ols('CM~RepPGNP',data = datos)

print(reg2.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: CM R-squared: 0.459

Model: OLS Adj. R-squared: 0.450

Method: Least Squares F-statistic: 52.61

Date: Thu, 22 May 2025 Prob (F-statistic): 7.82e-10

Time: 06:11:33 Log-Likelihood: -347.79

No. Observations: 64 AIC: 699.6

Df Residuals: 62 BIC: 703.9

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 81.7944 10.832 7.551 0.000 60.141 103.447

RepPGNP 2.727e+04 3759.999 7.254 0.000 1.98e+04 3.48e+04

==============================================================================

Omnibus: 0.147 Durbin-Watson: 1.959

Prob(Omnibus): 0.929 Jarque-Bera (JB): 0.334

Skew: 0.065 Prob(JB): 0.846

Kurtosis: 2.671 Cond. No. 534.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

8.2.2. Modelo log-lineal#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/ceosal2.csv"

datos = pd.read_csv(uu,header = None)

datos.columns = ["salary", "age", "college", "grad", "comten", "ceoten", "sales", "profits","mktval", "lsalary", "lsales", "lmktval", "comtensq", "ceotensq", "profmarg"]

datos.head()

reg1 = smf.ols('lsalary~ceoten',data = datos)

print(reg1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lsalary R-squared: 0.013

Model: OLS Adj. R-squared: 0.008

Method: Least Squares F-statistic: 2.334

Date: Thu, 22 May 2025 Prob (F-statistic): 0.128

Time: 06:11:33 Log-Likelihood: -160.84

No. Observations: 177 AIC: 325.7

Df Residuals: 175 BIC: 332.0

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 6.5055 0.068 95.682 0.000 6.371 6.640

ceoten 0.0097 0.006 1.528 0.128 -0.003 0.022

==============================================================================

Omnibus: 3.858 Durbin-Watson: 2.084

Prob(Omnibus): 0.145 Jarque-Bera (JB): 3.907

Skew: -0.189 Prob(JB): 0.142

Kurtosis: 3.622 Cond. No. 16.1

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

8.2.3. Regresión a través del origen#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/GA/Table%206_1.csv"

datos = pd.read_csv(uu,sep = ';')

datos.head()

lmod1 = smf.ols('Y~ -1+X',data = datos)

print(lmod1.fit().summary())

OLS Regression Results

=======================================================================================

Dep. Variable: Y R-squared (uncentered): 0.502

Model: OLS Adj. R-squared (uncentered): 0.500

Method: Least Squares F-statistic: 241.2

Date: Thu, 22 May 2025 Prob (F-statistic): 4.41e-38

Time: 06:11:33 Log-Likelihood: -751.30

No. Observations: 240 AIC: 1505.

Df Residuals: 239 BIC: 1508.

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

X 1.1555 0.074 15.532 0.000 1.009 1.302

==============================================================================

Omnibus: 9.576 Durbin-Watson: 1.973

Prob(Omnibus): 0.008 Jarque-Bera (JB): 13.569

Skew: -0.268 Prob(JB): 0.00113

Kurtosis: 4.034 Cond. No. 1.00

==============================================================================

Notes:

[1] R² is computed without centering (uncentered) since the model does not contain a constant.

[2] Standard Errors assume that the covariance matrix of the errors is correctly specified.

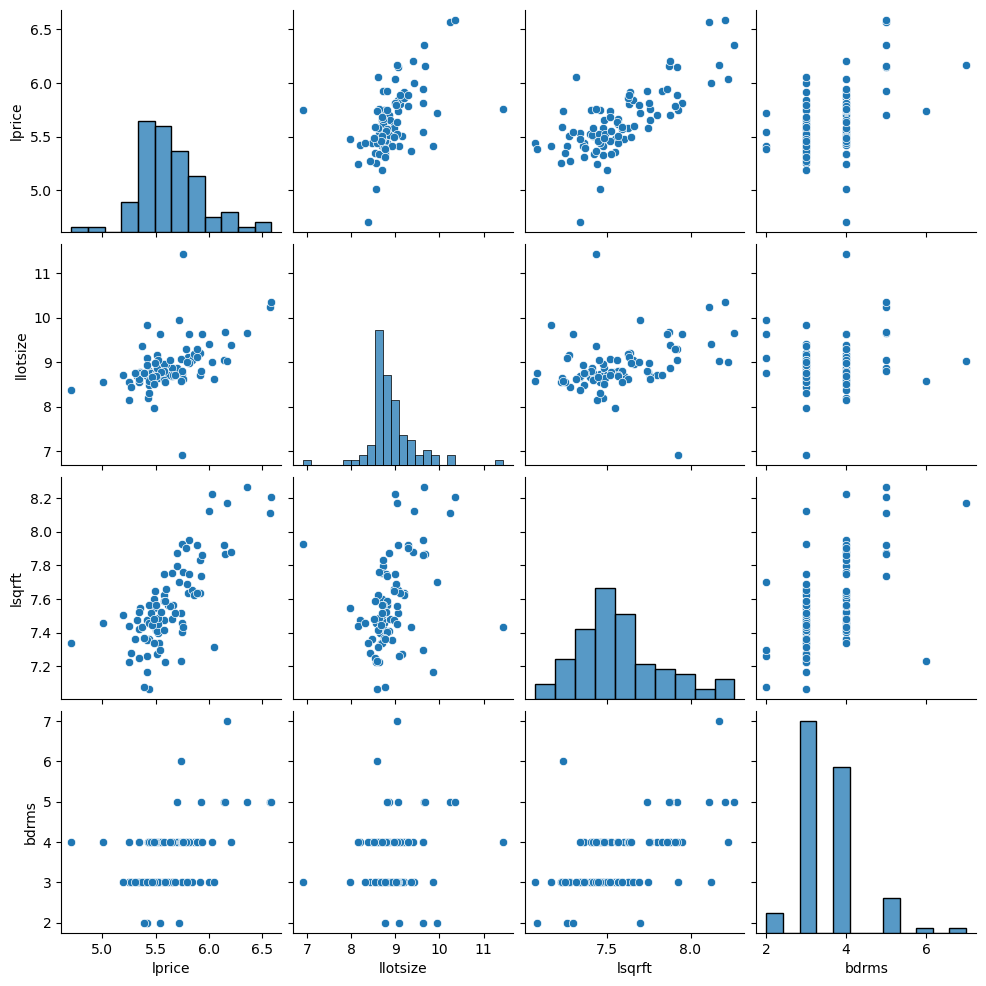

8.3. Regresión Lineal Múltiple#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/hprice1.csv"

datos = pd.read_csv(uu,header=None)

datos.columns = ["price" , "assess" ,

"bdrms" , "lotsize" ,

"sqrft" , "colonial",

"lprice" , "lassess" ,

"llotsize" , "lsqrft"]

datos.describe()

| price | assess | bdrms | lotsize | sqrft | colonial | lprice | lassess | llotsize | lsqrft | |

|---|---|---|---|---|---|---|---|---|---|---|

| count | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 | 88.000000 |

| mean | 293.546034 | 315.736364 | 3.568182 | 9019.863636 | 2013.693182 | 0.693182 | 5.633180 | 5.717994 | 8.905105 | 7.572610 |

| std | 102.713445 | 95.314437 | 0.841393 | 10174.150414 | 577.191583 | 0.463816 | 0.303573 | 0.262113 | 0.544060 | 0.258688 |

| min | 111.000000 | 198.700000 | 2.000000 | 1000.000000 | 1171.000000 | 0.000000 | 4.709530 | 5.291796 | 6.907755 | 7.065613 |

| 25% | 230.000000 | 253.900000 | 3.000000 | 5732.750000 | 1660.500000 | 0.000000 | 5.438079 | 5.536940 | 8.653908 | 7.414873 |

| 50% | 265.500000 | 290.200000 | 3.000000 | 6430.000000 | 1845.000000 | 1.000000 | 5.581613 | 5.670566 | 8.768719 | 7.520231 |

| 75% | 326.250000 | 352.125000 | 4.000000 | 8583.250000 | 2227.000000 | 1.000000 | 5.787642 | 5.863982 | 9.057567 | 7.708266 |

| max | 725.000000 | 708.600000 | 7.000000 | 92681.000000 | 3880.000000 | 1.000000 | 6.586172 | 6.563291 | 11.436920 | 8.263591 |

modelo1 = smf.ols('lprice~lassess+llotsize+lsqrft+bdrms',data = datos)

print(modelo1.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lprice R-squared: 0.773

Model: OLS Adj. R-squared: 0.762

Method: Least Squares F-statistic: 70.58

Date: Thu, 22 May 2025 Prob (F-statistic): 6.45e-26

Time: 06:11:34 Log-Likelihood: 45.750

No. Observations: 88 AIC: -81.50

Df Residuals: 83 BIC: -69.11

Df Model: 4

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 0.2637 0.570 0.463 0.645 -0.869 1.397

lassess 1.0431 0.151 6.887 0.000 0.742 1.344

llotsize 0.0074 0.039 0.193 0.848 -0.069 0.084

lsqrft -0.1032 0.138 -0.746 0.458 -0.379 0.172

bdrms 0.0338 0.022 1.531 0.129 -0.010 0.078

==============================================================================

Omnibus: 14.527 Durbin-Watson: 2.048

Prob(Omnibus): 0.001 Jarque-Bera (JB): 56.436

Skew: 0.118 Prob(JB): 5.56e-13

Kurtosis: 6.916 Cond. No. 501.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

modelo2 = smf.ols('lprice~llotsize+lsqrft+bdrms',data = datos)

print(modelo2.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lprice R-squared: 0.643

Model: OLS Adj. R-squared: 0.630

Method: Least Squares F-statistic: 50.42

Date: Thu, 22 May 2025 Prob (F-statistic): 9.74e-19

Time: 06:11:34 Log-Likelihood: 25.861

No. Observations: 88 AIC: -43.72

Df Residuals: 84 BIC: -33.81

Df Model: 3

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept -1.2970 0.651 -1.992 0.050 -2.592 -0.002

llotsize 0.1680 0.038 4.388 0.000 0.092 0.244

lsqrft 0.7002 0.093 7.540 0.000 0.516 0.885

bdrms 0.0370 0.028 1.342 0.183 -0.018 0.092

==============================================================================

Omnibus: 12.060 Durbin-Watson: 2.089

Prob(Omnibus): 0.002 Jarque-Bera (JB): 34.890

Skew: -0.188 Prob(JB): 2.65e-08

Kurtosis: 6.062 Cond. No. 410.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

modelo3 = smf.ols('lprice~bdrms',data = datos)

print(modelo3.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: lprice R-squared: 0.215

Model: OLS Adj. R-squared: 0.206

Method: Least Squares F-statistic: 23.53

Date: Thu, 22 May 2025 Prob (F-statistic): 5.43e-06

Time: 06:11:34 Log-Likelihood: -8.8147

No. Observations: 88 AIC: 21.63

Df Residuals: 86 BIC: 26.58

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 5.0365 0.126 39.862 0.000 4.785 5.288

bdrms 0.1672 0.034 4.851 0.000 0.099 0.236

==============================================================================

Omnibus: 7.476 Durbin-Watson: 2.056

Prob(Omnibus): 0.024 Jarque-Bera (JB): 13.085

Skew: -0.182 Prob(JB): 0.00144

Kurtosis: 4.854 Cond. No. 17.2

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

import seaborn as sns

sns.pairplot(datos.loc[:,['lprice','llotsize' , 'lsqrft' , 'bdrms']])

<seaborn.axisgrid.PairGrid at 0x31dd73080>

8.3.1. Predicción#

datos_nuevos = pd.DataFrame({'llotsize':np.log(2100),'lsqrft':np.log(8000),'bdrms':4},index = [0])

pred_vals = modelo2.fit().predict()

modelo2.fit().get_prediction().summary_frame().head()

| mean | mean_se | mean_ci_lower | mean_ci_upper | obs_ci_lower | obs_ci_upper | |

|---|---|---|---|---|---|---|

| 0 | 5.776577 | 0.029185 | 5.718541 | 5.834614 | 5.404916 | 6.148239 |

| 1 | 5.707740 | 0.029306 | 5.649463 | 5.766018 | 5.336041 | 6.079440 |

| 2 | 5.310543 | 0.033384 | 5.244156 | 5.376930 | 4.937486 | 5.683600 |

| 3 | 5.326681 | 0.031818 | 5.263407 | 5.389955 | 4.954165 | 5.699197 |

| 4 | 5.797220 | 0.031014 | 5.735544 | 5.858895 | 5.424972 | 6.169467 |

pred_vals = modelo2.fit().get_prediction(datos_nuevos)

pred_vals.summary_frame()

| mean | mean_se | mean_ci_lower | mean_ci_upper | obs_ci_lower | obs_ci_upper | |

|---|---|---|---|---|---|---|

| 0 | 6.428811 | 0.147975 | 6.134546 | 6.723076 | 5.958326 | 6.899296 |

8.3.2. RLM: Educación con insumos#

uu = "https://raw.githubusercontent.com/vmoprojs/DataLectures/master/WO/gpa1.csv"

datosgpa = pd.read_csv(uu, header = None)

datosgpa.columns = ["age", "soph", "junior", "senior", "senior5", "male", "campus", "business", "engineer", "colGPA", "hsGPA", "ACT", "job19", "job20", "drive", "bike", "walk", "voluntr", "PC", "greek", "car", "siblings", "bgfriend", "clubs", "skipped", "alcohol", "gradMI", "fathcoll", "mothcoll"]

reg4 = smf.ols('colGPA ~ PC', data = datosgpa)

print(reg4.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: colGPA R-squared: 0.050

Model: OLS Adj. R-squared: 0.043

Method: Least Squares F-statistic: 7.314

Date: Thu, 22 May 2025 Prob (F-statistic): 0.00770

Time: 06:11:35 Log-Likelihood: -56.641

No. Observations: 141 AIC: 117.3

Df Residuals: 139 BIC: 123.2

Df Model: 1

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 2.9894 0.040 75.678 0.000 2.911 3.068

PC 0.1695 0.063 2.704 0.008 0.046 0.293

==============================================================================

Omnibus: 2.136 Durbin-Watson: 1.941

Prob(Omnibus): 0.344 Jarque-Bera (JB): 1.852

Skew: 0.160 Prob(JB): 0.396

Kurtosis: 2.539 Cond. No. 2.45

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

reg5 = smf.ols('colGPA ~ PC + hsGPA + ACT', data = datosgpa)

print(reg5.fit().summary())

OLS Regression Results

==============================================================================

Dep. Variable: colGPA R-squared: 0.219

Model: OLS Adj. R-squared: 0.202

Method: Least Squares F-statistic: 12.83

Date: Thu, 22 May 2025 Prob (F-statistic): 1.93e-07

Time: 06:11:35 Log-Likelihood: -42.796

No. Observations: 141 AIC: 93.59

Df Residuals: 137 BIC: 105.4

Df Model: 3

Covariance Type: nonrobust

==============================================================================

coef std err t P>|t| [0.025 0.975]

------------------------------------------------------------------------------

Intercept 1.2635 0.333 3.793 0.000 0.605 1.922

PC 0.1573 0.057 2.746 0.007 0.044 0.271

hsGPA 0.4472 0.094 4.776 0.000 0.262 0.632

ACT 0.0087 0.011 0.822 0.413 -0.012 0.029

==============================================================================

Omnibus: 2.770 Durbin-Watson: 1.870

Prob(Omnibus): 0.250 Jarque-Bera (JB): 1.863

Skew: 0.016 Prob(JB): 0.394

Kurtosis: 2.438 Cond. No. 298.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.